Many millennials have had their entire working life coloured by the financial crisis of 2007-8. Canada Life’s research suggests that they have learned hard lessons about financial security and stability as a result.

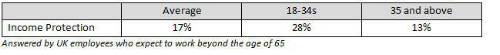

Table 1: Thinking about working beyond the age of 65, which of the following protection products offered by your employer would be most useful?

Almost half (44%) of those aged 55 and above are unsure about which benefits would be most useful as they prepare to work beyond the traditional retirement age, highlighting that employers and the Group Insurance industry could do more to educate this age group on the options available to them.

Opportunity to provide well-received benefits

There is a huge opportunity for employers to provide benefits which they know will be well-received by their staff. The 17% of people who expect to work beyond the age of 65 and believe GIP would be the most useful benefit translates to approximately 4 million3 workers, but only 2.5 million4 currently receive such benefits from their employer. That means there is a pool of at least 1.5 million employees in the UK who understand the value of Group Income Protection but are underserved in this department by their workplace.

There is a similar picture for Group Critical Illness (GCI). According to Canada Life’s research, 13% of employees who expect to work beyond 65 believe GCI would be most useful, equivalent to 3 million employees: yet barely 600,000 currently have access to this benefit. Awareness of GCI in general is on the rise in conjunction with the growing understanding of the health issues facing an ageing population, making an increase in future demand for this product even more likely.

Paul Avis, Marketing Director of Canada Life Group Insurance, comments: “There has been a consistent narrative in recent years that employees do not understand the value of employee benefits, especially ones like Group Income Protection. Our research shows a new generation of employees are more aware of and more engaged with non-salary employee benefits. It is questionable if our industry is doing enough to support these employees, perhaps by helping older, more experienced decision-makers in companies to understand them and the importance they place on subjects such as mental health support.

“Group Insurance products have long been under-penetrated in the UK. Only 4% of companies have our most common product, Group Life Insurance, and a fraction of that have Group Income Protection or Group Critical Illness. It is in our interests and the interests of prudent, forward-thinking employees for our industry to ensure businesses big and small are encouraged to protect their most valuable assets – their people. It fascinates me how readily companies protect their premises or property while resisting employee benefits, which could be short-sighted in the increasing war for talent.”

|