Current life expectancy figures from the ONS1 predict that a 65-year-old will live to 83 if a man, and 86 if a woman.

But when accounting for mortality improvement, that’s improvement in life expectancy over time, those entering retirement today should really expect to live seven years longer if a man and six years longer if a woman.

A 65-year-old man entering retirement with £250,000, would need to save a further £66,000 to maintain income levels for this further timescale.

The ONS[1] provides robust data on average life expectancy, but doesn’t use Continuous Mortality Improvement (CMI) to account for changes in mortality rates over time. For a 65-year-old entering retirement this year, and planning how long they need their savings to last, relying solely on ONS figures could lead to retirement ruin.

According to the ONS, a 65-year-old in the UK today can expect to live to age 83 if a man and near age 86 if a woman.

However, according to the research by Aegon incorporating EValue mortality improvement data, the average life expectancy is in fact seven years longer for a man at 90, and six years longer for a woman at 92.

That means, a man with a pot of £250,000 would need to save £66,000 more to cover this further seven years in retirement if he wanted to maintain a sustainable income of £12,400 every year. A woman with a pot of £250,000 would need to save £49,000 more to cover this further six years in retirement if she wanted to maintain a sustainable income of £10,900 every year.

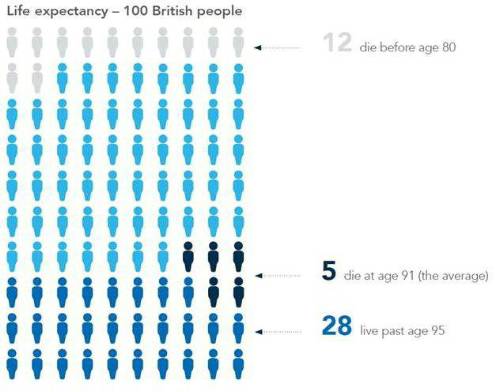

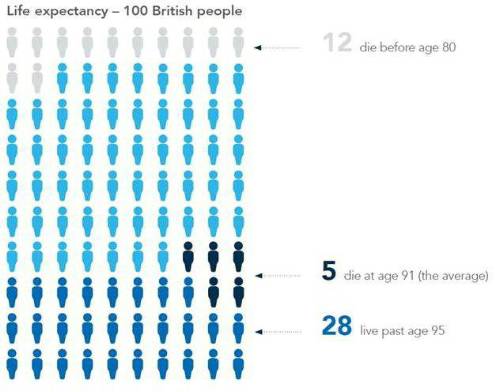

However, even these average life expectancies based on improving mortality shouldn’t be relied upon when retirement planning. Aegon and EValue’s analysis shows that many people are likely to live even longer, women in the UK have a one in three chance of living to age to 95 and for men there is a one in four chance. Looking at life expectancy for the UK as a whole and based on current 65-year-olds, 12% of the population will die before age 80, just 5% will die at age 91, the average, and 28% will survive beyond age 95. While illness, disease and lifestyle choices may reduce life expectancy for some, the projections highlight the difficulty of planning for an event where the end date is unknown and show just how important it is to factor living longer into retirement planning.

Source: EValue - 2017

(Note: Unlabelled section relates to the rest of the population, other than those labelled.)

Steven Cameron, Pensions Director at Aegon, said: “Preparing for retirement is uniquely challenging because it involves planning an income for an unknown period of time. The pension freedoms have made it absolutely critical that advisers and their clients are using the right tools to plan for retirement, especially when it comes to estimating how long someone is likely to live. National statistics are an obvious first port of call, but they can never be more than a blunt tool for estimating individual life expectancy.

“Advisers don’t have a crystal ball any more than retirees do themselves, but average life expectancy statistics should only ever be a starting point. Improving mortality over time could push up the average by half a decade, and people also need to factor in variations based on health, genetics and lifestyle. The upshot is that people should prepare financially to live significantly longer.”

“For advisers, one solution is to focus on ‘survival probability’: the chances that someone will live until a certain age. By taking into account improving trends in life expectancy, retirees and their advisers can both agree on an acceptable level of risk that they will outlive a certain age, and plan around this.”

|