Analysis from retirement specialist Just Group reveals a worrying ‘planning gap’ among people nearing the end of their career while those with no later-life savings are particularly at risk of poorer outcomes due to a lack of preparation.

The research was conducted among the 45-65 age group, those closest to the end of their working careers and starting the transition towards retirement.

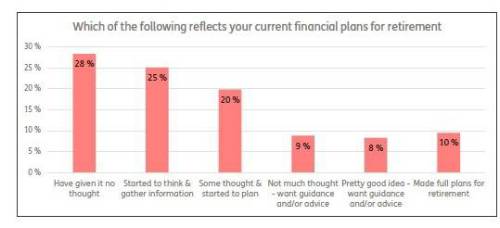

It found that nearly three in 10 (28%) 45-65s haven’t given any thought at all to their retirement plans, including a quarter (25%) of 56 to 65-year-olds.

Only one in 10 (10%) had made full plans for retirement – this rises to 14% among 55 to 64 year- olds but still remains worryingly low.

This ‘planning gap’ is most evident among those already at risk of a lower standard of living in retirement – 56% of those without a pension said that they hadn’t given retirement any thoughts.

There is certainly an appetite for more help in preparing for retirement. Nearly a fifth (17%) said they would welcome some advice and/or guidance on their options.

Stephen Lowe, group communications director at the retirement specialist Just Group, encouraged those entering the twilight of their career to start planning now and get retirement ready: “We teach children to ‘Be Prepared’ but this advice is arguably more important for those approaching retirement wanting to secure a good standard of living,” he said.

“It is worrying that so many people are failing to put plans in place as they enter the final decade or two before the end of their career. Planning helps people avoid poor outcomes and it is never too late, even for those with very modest pension savings.

“Not everybody will have access to an adviser or will want to pay for regulated advice. However, the government’s free, independent and impartial guidance service Pension Wise is available to all those aged 50+ with a defined contribution pension and is a great place to get a quick understanding of all the options at retirement to encourage more in-depth planning.

“Employers are also increasingly putting automated planning solutions in action. These can give workers a lower-cost way of accessing regulated advice to help them put in place plans that will help achieve good outcomes in retirement.”

|