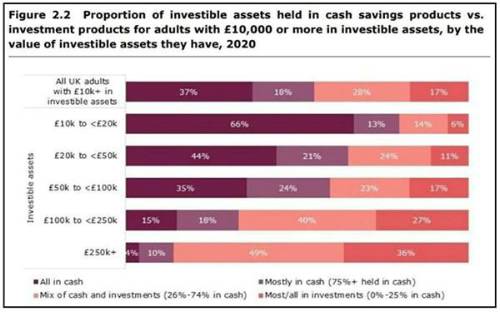

The statistics reveal that nearly two-fifths of adults with more than £10k in investible assets hold all their savings in cash, with another 18% holding most of their savings (>75%) in cash.

The paltry returns on offer from cash savings accounts were laid bare by the FCA in the report. It said through Which? research that of the 1,600 cash savings accounts analysed in January 2019 using data from Moneyfacts, only 170 accounts paid more than the Consumer Price Index meaning that over time the real value of the cash savings is eroded.

Shockingly, whilst those with larger assets are less likely to keep them in cash, there are still a surprising number of people with significant sums of money being eroded in real terms in cash accounts.

More than a third of those with investible assets of £50-100k hold the full amount in cash with a further quarter (24%) holding most of their assets in cash. Additionally, a third of those with investible assets of £100-£250k hold savings either fully in cash (15%) or mostly in cash (18%).

Paul Matthews, CEO of EQ Boardroom believes more needs to be done to kickstart people’s investment journeys.

“The FCA figures are clear evidence that too many people are leaving substantial assets in cash accounts where they are losing value. More can be done to encourage people to take their first steps into investing to make their money work harder.

“Sharesave schemes are a great way to get people who might otherwise take the path of least resistance and leave their money in cash savings, to consider taking their first steps towards investing in stocks. They offer employees a low-risk method of investing in their employer and often give participants the confidence to try other forms of investing.

“We urge employers to consider the value that their employees could take from the establishment of these schemes – not to mention the boost to productivity and engagement that owning a share in the company you work for can bring.”

|