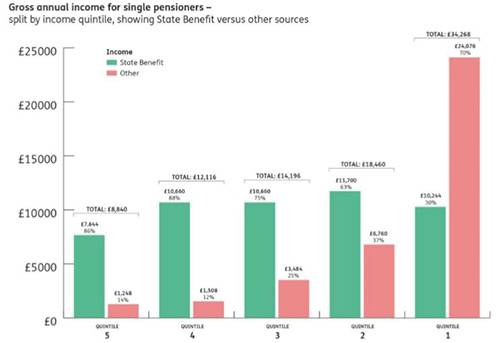

In comparison, retirees in the second richest quintile get an extra £4,000 in financial support from the State, 53% more each year than those with the smallest incomes. Even the top quintile receives around £2,500 more than the poorest pensioners despite their annual income being £25,000 higher. Benefits are crucial for lower income pensioners with the figures revealing that it accounts for nearly 90p of every pound they have to spend but only makes up 30% of the top quintile’s income.

Stephen Lowe, group communications director at Just Group, says the figures demonstrate how reliant the poorest pensioners are on the State Pension despite its insufficient allowance. “The State Pension forms the bedrock of retirement finances for the majority of pensioners and these figures reveal just how much the poorest rely on it, as well as other benefits ranging from Pension Credit to the winter fuel allowance.

“Millions of pensioners are dependent on this State support but still their income falls some way short of the Joseph Rowntree’s Minimum Income Standard of £10,452 a year for a single pensioner. “State Pension Shortfall Day was reached 42 days ago3, the point in the year when the full State Pension entitlement would only support living costs for the average single pensioner until the end of August. Beyond this point in the year, retirees on an average rate of expenditure would need to fund the final four months of the year through their own purse or additional support from the State.”

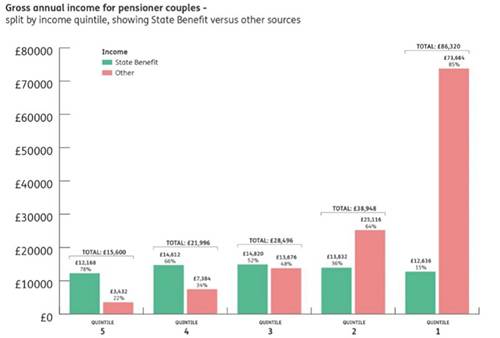

It is a similar story for pensioner couples with the poorest obtaining £12,168 a year in benefits, £500 a year less than the top quintile and £2,652 less than retired couples in the middle quintile. State Benefits account for 78% of their annual income, a proportion that steadily decreases through the quintiles. Stephen Lowe pointed to Just Group’s data obtained from working with pensioner homeowners as evidence that many could boost their income simply by claiming their full Benefits entitlement. “We found when delivering advice that half of all pensioner homeowners are not claiming any benefits beyond the State Pension and a further fifth are not claiming their full entitlement.

|