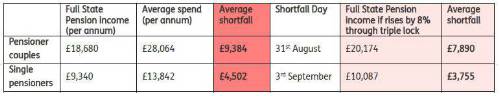

Two full State Pensions are equal to £18,680 a year and official figures show that the average annual spending for a two-person retired household is £28,0641. This leaves a gap of £9,384 that needs to be plugged by additional sources of income such as private pension provision or other savings and investments, otherwise the retired couple will have run out of money by the end of August (31st).

Single pensioners entitled to the full State Pension receive £9,340 per year and spend £13,842 a year on average2. This represents a shortfall of £4,502 and without additional sources of income this group would have run out of income by Friday this week (3rd September).

Speculation has been rife that the government may abandon the State Pension triple lock, the promise to raise the State Pension by the highest of three measures – the rise in Consumer Price Index (CPI), the rise in average earnings or 2.5%.

However, analysis by Just Group reveals that even if the triple lock was implemented at 8%, single pensioners would still face a shortfall of more than £3,500 every year, and nearly £8,000 for retired couples, in order for them to reach the average yearly spending in retirement.

“If the average pensioner couple was given two State Pensions in full on 1 January, by today (31 August) they would have spent the entire amount and be reliant on other sources of income,” said Stephen Lowe, group communications director at Just Group.

“Single pensioners would use up their income slightly slower and exhaust a full State Pension by the end of this week. The data reveals the shortcomings of the State Pension for those who rely on it as their main source of income.

“It’s a reminder that putting off saving or opting out of a workplace pension scheme can leave people struggling for income in later life. Those thinking of accessing pensions cash before they retire will also want to consider what that might mean for their income in a few years’ or decades’ time.

“The Government’s free, independent and impartial guidance service – Pension Wise – helps people approaching retirement to understand their options better. Before tapping into pension savings, we urge everyone who’s entitled to a free Pension Wise session to make use of it – it’s proven to improve people’s knowledge of their retirement options and equip them with greater confidence to make good decisions about their retirement finances.

“Retirees struggling for income should make sure they are claiming their full State Benefits entitlement as large amounts go unclaimed every year. Our research shows that homeowners are particularly susceptible to missing out on potential income: four in 10 eligible pensioner homeowners fail to claim any State Benefits and a further 20% miss out on their full entitlement, losing hundreds of pounds a year, on average3.

“A good online source for further information is direct.gov.uk but Citizens Advice and other charities might

also be worth contacting.”

|