With over two months of the year still to go, we have now reached the point in 2022 when the average single pensioner will have already spent income equivalent to a full annual State Pension. This marks the arrival of State Pension Shortfall Day, according to analysis by retirement specialist Just Group.

This year, the data reflects a 15% fall in average spending1 during the pandemic due to the lockdowns that restricted travel, eating out and leisure activities, delaying ‘shortfall day’ by about seven weeks. However, a return to more normal spending patterns combined with soaring household bills is likely to advance the date significantly in 2023.

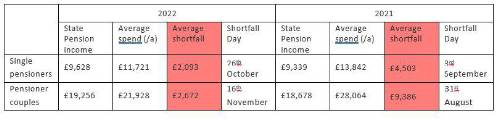

Single pensioner average spending in 2021/22 was £11,721 compared to State Pension annual income of £9,628, a shortfall of £2,093 or more than two months of annual spending, putting ‘shortfall day’ at 26th October. This is effectively extra money they would need to find from other sources.

For couples receiving full State Pension of £19,256 but spending £21,928, the £2,672 shortfall suggests a ‘shortfall day’ of 16th November, which is about 10 weeks later than the previous year.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “State Pension payments are spread over the whole year and don’t abruptly stop on a set date, so the notion of ‘shortfall day’ is to highlight the size of the gap between annual State Pension and typical yearly spending.

“It shows that if State Pension was paid as a lump sum at the start of the year, the average spending single pensioner would have used up all that money by today, and be reliant on other sources of income such as pensions, savings and benefits.

“This year’s data reveals that even with spending severely curtailed by unprecedented restrictions, single pensioners are still faced with finding extra income equivalent to more than two months of State Pension, while couples will still need to find six weeks’.

“It’s worth noting too, that the data does not take into account the current cost-of-living crisis with energy and food bills rising sharply. Energy bills often affect pensioners disproportionately and as a result the reality may be much starker than these figures present, despite the additional government support in place.

“This is why the government’s commitment to the triple lock – the guarantee that the value of State Pension will at least keep up with inflation – is so important for pensioners facing a bleak winter.

“Any retiree struggling for income should make sure they are claiming their full State Benefits entitlement as large amounts go unclaimed every year. Our data shows that nearly half (49%) of homeowners eligible for benefits are failing to claim any benefit missing out on £1,197 a year, while two in 10 (21%) homeowners are underclaiming with an average loss of £1,220 extra income.

“A good online source for further information is direct.gov.uk but Citizens Advice and other charities

might also be worth contacting.”

|