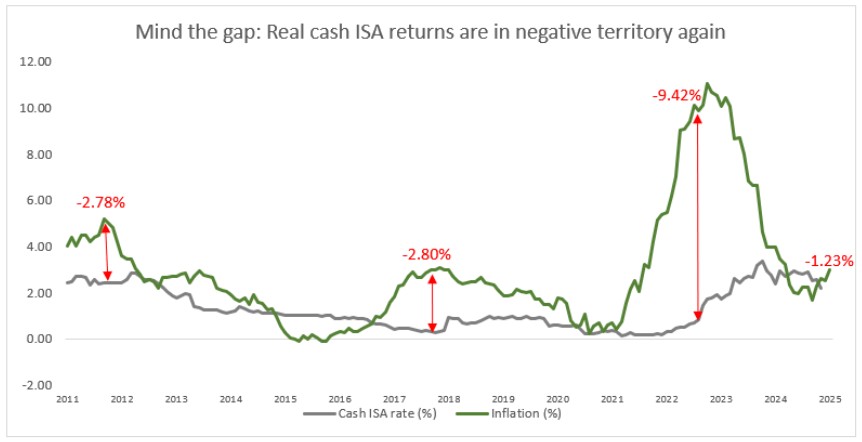

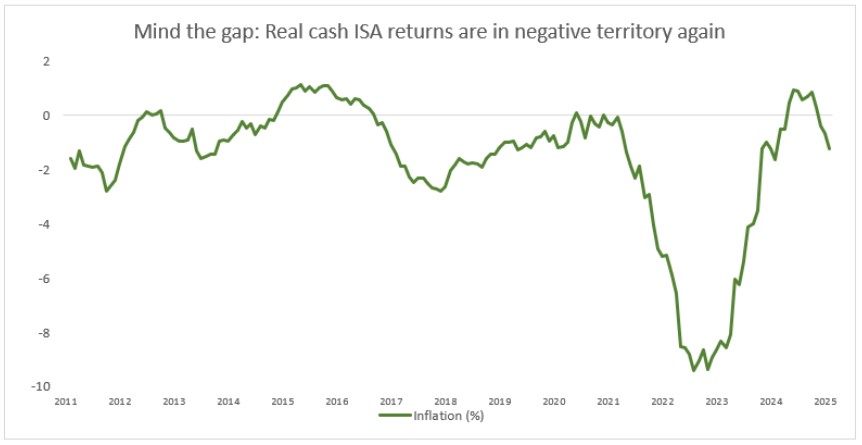

With CPI inflation hitting 3% in the 12 months to January 2025, and the monthly interest rates available on cash ISA deposits, including unconditional bonuses, dropping to 1.77%, cash ISA savers face a real terms loss of 1.23%.

The news comes after significant speculation that Chancellor Rachel Reeves is planning to change the tax benefits of cash ISAs to help boost investment in the spring.

January is the third month in a row where savers suffered a real terms loss on cash ISA savings since March 2024. However, back in July 2022, cash ISA savers were suffering a historic 9.4% loss on their money as inflation eroded their savings.

Source: ONS, Bank of England, Quilter

This trend is likely to continue. Inflation may increase slightly again, and most predictions are that the Bank of England will cut interest rates at least twice in 2025, widening the gulf further.

Quilter is warning cash ISA savers to mind the gap and consider a stocks and shares ISA in the new tax year if they are able to lock the money away for a few years, given stocks and shares have a better chance of keeping pace with inflation.

Someone who invested £10,000 in a cash ISA in December 2012 would currently have £11,955. Adjusted for inflation, this is just £7,918. In contrast, a £10,000 investment in the IA Global Equity index over the same period would be worth £33,526 or £22,221 after inflation.

According to the latest HMRC data available, 12.4 million adult ISAs were subscribed to in 2021/22, of which 63% were cash ISAs.

Holly Tomlinson, financial planner at Quilter, commented: “Following a relatively rare period of cash ISAs delivering above inflation returns we are now back to people losing money in real terms by keeping their money in cash.

“Rumours have been swirling that the government might scrap or scale back cash ISAs, which would be a clear push to shift the UK’s savings culture towards investment.

“That’s not necessarily a bad thing as too much wealth sits in low-yielding cash when long-term investing could deliver better returns and fuel economic growth.

“While this data shows that cash ISAs are not the best place to save to get the best returns, these types of accounts still have their place. Your saving goal might be in the short-term meaning you can’t take on the inherent risk that comes with investing.

“However, there is no doubt that the government needs to address the UK’s love affair with cash. But the approach to the cash ISA should be reform, not removal. Capping tax-free cash savings or improving incentives for investment ISAs could strike the right balance. The UK does need to boost its investment culture, but that shouldn’t come at the expense of savers who rely on cash for stability.”

Holly’s tips for getting started with investing:

Diversify, diversify, diversify: The first rule of investing is to diversify your portfolio to reduce the risk. For example, by buying a range of shares and having a diverse asset allocation including bonds, property and alternatives.

Understand what you are investing in: The investment universe is enormous and growing at a rapid rate. It is important to know exactly what you are buying, what the return drivers are and what the risks are.

Have a realistic plan: Investing is a marathon, not a sprint. You need to know how much you can realistically set aside each month to invest, understand your capacity for loss, and get exposure to a suitable amount of risk given your investment objectives.

Beware of social media money ‘mentors’: When people want to invest, they often turn to social media for tips. But anyone can set up a profile and start offering advice so be careful who you trust. If you are unsure and want an expert to guide you through, stick to regulated and trusted financial advice.

Remind yourself of scam red flags: Investment scams facilitated online and on social media are becoming more and more prevalent. Be wary of an investment proposition that offers an unrealistic rate of return, which downplays the risks or puts you under time pressure to make a decision. If in doubt, check the FCA’s register and make sure you a dealing with a regulated financial services firm. For more information visit https://www.fca.org.uk/scamsmart.

|