By Mark Mullaney, Head of Partnerships and Distribution at Beagle Street

It says that if using an interest rate calculator of 4.75%, “the typical monthly repayment on a fixed-rate mortgage will rise from around £700 to £1,100 on average, and from around £500 to £900 on average for those on a variable-rate mortgage. That represents a 50 per cent increase. This £400 increase in monthly repayments will wipe out the savings of a further 1.4 million households by 2024 as a result of higher mortgage repayments. This would take the total number of households with no savings to around 7 million, that is 25 per cent or 1 in 4 UK households.”

Of course, these changes also need to be considered in the wider economic context. Life has been made more challenging for many due to the price of consumer goods and services rising at the fastest rate in four decades in the year to October 2022, according to the ONS. The rate of inflation has since slowed down, at 6.8% in the year to July 2023, but it is still well above the Bank of England's target rate of 2%. Meanwhile, regular pay (which excludes bonuses) saw a small growth of 0.1% in April to June 2023, when measured in real terms – a positive trend, but not nearly enough to compensate for other pressures.

What does this mean for life cover?

For intermediaries and brokers in the life insurance market, this financial context can pose a challenge when persuading homeowners that they need to take out life insurance to cover their mortgage debt. Householders are more likely to be assessing their monthly bills to strip back expenses, rather than looking to take on new financial commitments.

Nevertheless, life cover for mortgage debt is one of those rare instances where the benefits of the product are incontrovertibly in the interests of the consumer. For most UK households, mortgage debt is the largest loan they will ever commit to and provides that most essential of services – a roof for them and their family. And if it becomes unaffordable (for instance, because the main breadwinner has died prematurely) the effect on surviving dependents’ lives could be catastrophic in a multitude of ways – financially, professionally, mentally, educationally, and more.

The industry needs to not only promote the risks of not having life cover, but also the affordability of protection. Ironically, it is those people where the impact of a premature, uninsured death can be most devastating – families with young children – who are often the least costly to insure. Typically, a young person with a family can expect to obtain life cover of £200,000+ for around £10/month (based on a 30 year old non-smoker, with £225k decreasing term cover for 20 years, and not on an interest-only mortgage), which is equivalent to taking on a basic mobile phone contract or foregoing a visit to the cinema.

Mind the Mortgage Cover Gap

For intermediaries and brokers, the big opportunity is among consumers who have not covered (or presently don’t intend to cover) their mortgage debt. But just what proportion of the nation is without insurance for their household, leaving surviving partners and/or families exposed to the risk of potentially losing their home?

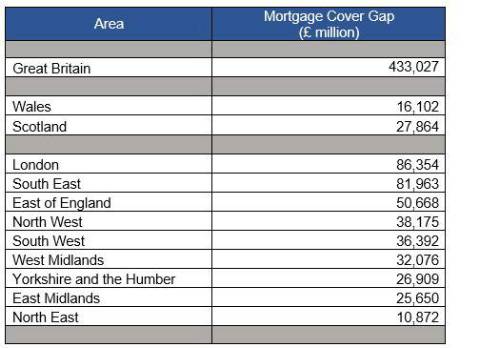

Beagle Street commissioned analysis from independent research organisation MindMetre to model the current mortgaged home-value-at-risk, with mortgage holders who do not have life insurance cover. This potential liability for homeowners should their partner die unexpectedly has been christened the ‘Mortgage Cover Gap’.

The study combined official data on average house prices, mean mortgage penetration, average loan-to-value and the most ‘conservative’ available intelligence on life insurance take-up to protect mortgage debt.

The figures shown in the table below total the mortgage debt estimate for each region of England, as well as for Wales and Scotland, that is not protected with life insurance. These totals are influenced by differing house prices, LTV rates, mortgage debt penetration, and so on.

The findings highlight a clear gap in the market, with over £400 billion of mortgage debt in the UK at risk (in the event of premature death) due to the absence of life insurance coverage and underscore the urgent need within the industry to raise awareness and educate homeowners about the importance of financially safeguarding themselves and their families. Any further financial instability, such as the loss of a loved one and a second income, could tip the financial balance beyond recovery.

Evidence, affordability and next steps

The study provides useful insights for insurance intermediaries and brokers looking to persuade a greater proportion of the publication to protect their families with life insurance cover. While brokers, introducers, mortgage advisors and other insurance sales channels have an expert understanding of their own marketplaces, this study is an additional tool to encourage market uptake and demonstrate the scale of the Mortgage Cover Gap.

For intermediaries, this data can be used as a business growth tool to:

• Assess regional potential for life insurance uptake (to cover mortgage risk)

• Offer compelling evidence of the population at risk in any given area of the country

• Create engaging marketing and advertising messages based on reliable data

• Articulate robust evidence to potential customers around the benefits of mortgage protection through life insurance.

|