Thousands of savers aged 55+ who have taken a flexible payment from their pension are hamstrung from saving for retirement and risk unexpected tax bills, due to government failure to inflation-adjust limits on how much they can save into pensions.

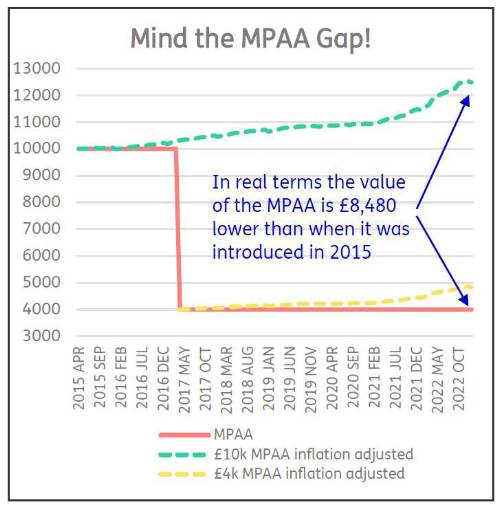

Analysis by retirement specialist Just Group shows that the Money Purchase Annual Allowance (MPAA), which was £10,000 when it was first introduced in 2015, would now be worth £12,480 if adjusted for rising prices.

Instead, the allowance was cut to £4,000 in 2017 where it has remained frozen despite inflation picking up sharply in recent months. In real terms, that means the MPAA is £8,480 less than when it first came into force.

Stephen Lowe, group communications director at the retirement specialist, Just Group, said that more than 2 million people have taken a flexible payment from a pension since 2015 and thousands still saving into a pension are likely to breach the MPAA, although many will be unaware of the onerous rules.

“The MPAA is designed to stop people recycling cash back into pensions to double-claim tax relief,” he said. “Back in 2015 with a £10,000 limit, it would have affected relatively few. Reducing it to £4,000 and freezing it since then is capturing thousands of workers each year.

“The cost of living crisis has seen many people aged over 55 use their pension savings to help them through a financially difficult patch. On top of that, wage growth has picked up resulting in higher pension savings. A low MPAA and higher pensions savings see many people either hamstrung in how much they can save or subject to unexpected tax charges.

“We would like to see the Chancellor of the Exchequer increase the MPAA in the Spring Budget because the government needs to encourage more of those aged 55+ back into the workforce.”

HMRC figures show that, since 2015, more than 2 million people have taken flexible payments worth £60 billion from pensions. Another 250,000 join them each year, becoming subject to the MPAA rules while many are continuing to work and contribute to pensions.

“Once you take a flexible payment, you become personally responsible for calculating your total pension input each year. You must tell HMRC if the total amount going into a defined contribution pension – including personal and employer contributions plus tax relief – exceeds the MPAA and pay any tax on the excess.”

He said that not all withdrawals from pensions are flexible withdrawals, potentially adding to the confusion. Those using their entitlement to take up to 25% tax free cash will not be subject to the MPAA, along with those withdrawing small pension pots worth up to £10,000 or using their retirement fund to buy a guaranteed income for life from a pension annuity.

“The rules are complicated which is why we recommend people take the free, independent and impartial guidance from Pension Wise and, ideally, regulated advice from a professional adviser,” said Stephen Lowe.

“That should help people understand their responsibilities and the consequences of decisions to take pension funds early. It’s not just unexpected tax charges but also the fact that pensions are a valuable perk so you really don’t want to miss out on tax-relief.”

|