In the Solvency II world, capital efficiency will be of paramount importance. For life insurers with large unit-linked portfolios, choosing an appropriate unit-matching process will be an important part of their capital management programme. There will be the potential to release cash from the unit-linked funds for other capital purposes, with the elimination of unnecessary forced investment into the unit-funds being a very welcome development for finance directors. This article details the practical issues involved and the systems required to operate the business processes with appropriate risk management and reporting.

Article 132(3) of the Solvency II requirement states that technical provisions for unit-linked contracts must be represented as closely as possible by units. However the investment policy for the amount (‘excess value amount’) representing the excess of the face value of the unit-linked liabilities over the Solvency II technical provisions is not specifically prescribed.

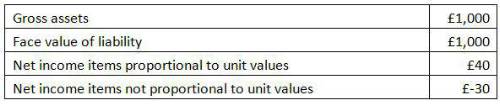

Consider an example where:

What is the optimum unit matching approach to adopt and is that consistent with Article 132(3)?

Under Solvency II, the required technical provisions in this example are 990 but it is arguable that for the purposes of applying Article 132(3) the technical provisions could be interpreted as 1,000-40 = 960, based on the face value of units less present value in force (PVIF) of future management charges.

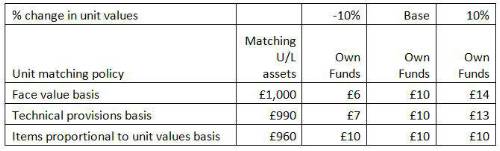

Question: Is the excess value amount 10 or 40? This depends on how the Prudential Regulatory Authority (PTA) defines technical provisions for close matching purposes under Solvency II. The effect on own funds (assuming no change in the risk margin and that cash is held in respect of amounts not invested in the unit-linked funds) is shown below for various alternative unit matching approaches.

If a life company wishes to minimise the volatility of their Solvency II-basis own funds (subject to changes in the risk margin), the optimum unit-matching approach is based on 960 i.e. the excess value amount is 40 and is not invested in the unit funds. By definition, this would minimise the market-risk SCR on unit-linked assets (unless the life insurer chooses to hold more unit-linked assets – e.g. in respect of the risk margin or to match the SCR for lapse risk).

For unit-linked life companies, this could mean unit-matching to the face value of units less PVIF of net future management charges i.e. matching to those parts of the technical provisions that are proportional to unit values. Whilst the unit-matching process would be more complex than the existing business process, it could be handled by an appropriately configured fund administration system with box management functionality. The fund administration system would need to separately record the two components of the unit-matching by firstly matching the face value of units and secondly the underfunding in respect of the PVIF of future management charges, and then calculate the profit/loss on the underfunding for IFRS reporting purposes. Good analytical functionality would provide the ability to access the size of the underfunding positions and the gains or losses on those positions at any given time. Such reporting and analytical capabilities are a fundamental element of the system, for validation purposes and cross-reporting to the actuarial function.

To give practical effect to this, the life company would need to apply unit-matching based on proportions of the face value of units where the proportions vary by fund and over time.

The relevant proportion at fund level is {[Face Value] – [PVIF]} / [Face Value].

Periodic calculations would need to be carried out separately for each fund or group of funds to determine the relevant proportions and to determine the PVIF of future management charges.

A key question would be the extent to which the relevant proportion for a fund would vary over time as variability arises because:

The relevant proportions for a fund might vary between existing business and new business because of different product mix

The relevant proportion for a fund for existing business would be an aggregate figure across multiple products (e.g. products linked to different unit series of the fund) and inflows/outflows for a fund wouldn’t be uniformly distributed over the products

In this instance, the relevant proportion of a fund at a calculation date across aggregate products could be used as the relevant proportion until the following recalculation date.

In practice the proportions would only be recalculated every 3, 6, or 12 months depending on the frequency of calculation of technical provisions. At each calculation date, sensitivity analysis would need to be carried out to determine the sensitivity of the relevant proportion to various parameters such as the size of inflows/outflows to the funds, the product mix, etc. For example the calculation process could determine the relevant proportion for a fund by product group to help understand the potential consequences of its large inflows/outflows. The fund administration system would therefore need a risk management framework to monitor these parameters between calculation dates and to produce alerts if they were to fall outside a specified range.

It’s important not to lose sight of the big picture objective when considering such practical issues. There are approximations involved so a life company will never be perfectly matched at any time to the face value of units less PVIF of future management charges. However adopting this approach and having a robust fund administration system to manage the process would minimise the extent of mismatching, with the resultant important capital efficiencies.

In summary, for life insurers with large unit-linked portfolios, the elimination of unnecessary forced investment into unit-funds, offers significant opportunity to release cash for other purposes. However it is crucial that the functionality and reporting capabilities of their fund administration system - for validation purposes and cross-reporting to the actuarial function – provide the ability to accurately manage the unit-linked matching process and ensure a successful and compliant capital management programme.

|