Good news stories might appear suggesting that funding deficits of defined benefit (DB) pension schemes will fall as interest rates rise. However, a rise in short-term interest rates could have very little to no impact on longer-dated gilt yields that many pension schemes use to value their liabilities.

Bad news stories might appear suggesting that an interest rate rise will signal a fall in the size of transfer values, frightening some people to rush for the door before they go any lower.

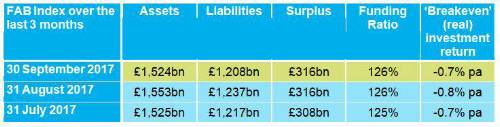

Over the month to 30 September 2017, the FAB Index did not move, with the surplus of the UK’s 6,000 DB pension schemes remaining at £316bn and the funding ratio at 126%.

In contrast, the deficit on the PPF 7800 Index continued to yo-yo, bouncing back over September from a deficit of £220.4bn to £158.0bn.

First Actuarial Partner Rob Hammond said: “With expectations of an interest rate rise, we saw a rise in gilt yields in September which was reflected in the PPF deficit improvement. Pension schemes that use gilts-plus funding methodology when not invested wholly in gilts, may also have seen a reduction in their funding deficits.

“If long-term gilt yields increase further, funding may improve again. For example, a long-term gilt yield rise of just 0.25% to 0.5% pa could wipe out the whole of the deficit reported by the PPF 7800 Index.

“However, higher short-term interest rates may not translate into higher long-term gilt yields. Indeed, there was little movement in gilt yields over October, which suggests this has already been priced in. So, sponsors should beware of good news stories that suggest an interest rate rise will be good for pension schemes.

“As shown in September, our FAB Index is virtually immune to changes in gilt yields, as it aligns the value of assets and liabilities, and so will provide a useful barometer to any misguided optimism.”

Hammond added: “Members should also beware of bad news stories that suggest transfer values will start to fall if the Bank of England raises interest rates. This might not be the case (or may have already happened), and such pessimistic headlines will add yet more scaremongering to that which has spooked many to cash in their valuable defined benefit pension.”

The technical bit…

Over the month to 30 September 2017, the FAB Index did not move, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes remaining at £316bn.

The deficit on the PPF 7800 Index improved over September from £220.4bn to £158.0bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best estimate basis – the so called ‘breakeven’ (real) investment return – has remained at around minus 0.7% pa. That means the schemes need an overall actual (nominal) return of 2.9% pa for the assets to meet the liabilities.

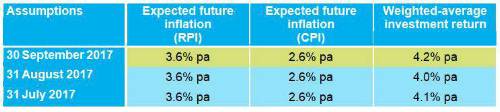

The assumptions underlying the FAB Index are shown below:

|