|

|

AA Insurance has hailed the proposed increase in penalties for using a hand-held mobile phone or other device while driving as a ‘victory for common sense’. Until now the CU80 offence for using a hand-held phone has attracted the same fixed penalty as speeding – three penalty points and a £100 fine. The Government has announced that it plans to increase the penalty to four points and a £150 fine. |

• Insurers will welcome proposed penalty increase

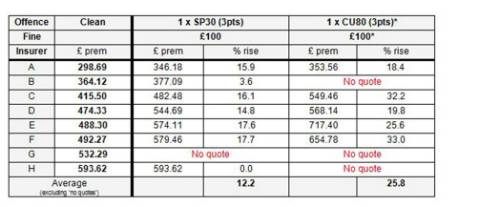

• Mobile phone offences already dealt with seriously by insurers • 31% say mobile phone use ‘most irritating driver behaviour’ • Mobile phone offenders ‘four times more likely to crash’ Michael Lloyd, director of broker AA Insurance, says that the Government is at last catching up with the insurance industry, which has long regarded mobile phone offences as being significantly more serious than speeding. “Drivers using a handheld mobile phone are at four times greater risk of having a crash than a driver not using one(1) and I’m delighted that the penalty will now better reflect the seriousness of this offence. “Insurers already reflect this in the premiums of offenders who can expect an average premium increase twice that imposed for a speeding conviction (see table). “While drivers may mistakenly exceed a speed limit, no-one uses a handheld phone by mistake. It’s a deliberate act that seriously diverts attention from driving, significantly heightening the risk of a crash.” Mr Lloyd adds that a few insurance companies might overlook a first speeding offence while most will ignore those who opt to take a safety awareness course instead of a fine and licence endorsement. “But all insurers will penalise those who commit a mobile phone offence and some may even decline to renew cover when a policy comes up for renewal. Offenders are much more likely to make a claim. “So their premium will reflect that risk.” AA-Populus research last year(2) revealed that 23% of over 19,000 AA members admitted that they had: ‘been distracted, had a near miss or a crash over the previous 12 months’ while using or interacting in some way with mobile phone or other mobile device. AA members also ranked hand held phone use, alongside tailgating, as the two most irritating and dangerous actions on the roads in an AA-Populus poll of 29,660 drivers earlier this year(4). Mr Lloyd says: “These are shocking admissions that underline the widespread use of and danger posed by hand-held phones. If a driver is texting, or calling, they aren’t concentrating and are taking their eyes off the road. “No call or text can be more important than that.” Edmund King, AA president added: “This epidemic of hand held mobile phone use while driving has already cost lives and drivers have demanded action. Three quarters of drivers see others using mobile phones on some or most journeys, with one quarter seeing it on every journey, according to our polls (5). “The majority of drivers will welcome these increased fines and penalty points, alongside driver improvement courses, to tackle those who use hand held mobiles at the wheel.” The effect of traffic offences on car insurance premiums AA Insurance conducted research among eight insurers on its panel offering the cheapest quotes for a 35-year-old man driving a Ford Mondeo assuming a clean licence; and compared with premiums following motoring offence(s). Note that the CU80 mobile phone offence is sometimes escalated to CD10 (careless driving).  Note: The percentage premium increase for the offence will typically reduce by 10% to 15% after the first year and reduce again after the second and third, normally being cleared after the third. However, in some cases offences may be taken into consideration for up to five years. The quotes are for new business. ‘No quote’ means that an insurer will not offer cover to a driver with the stated offence; it may also decline to continue cover when the policy is renewed. Some phone offences might be increased to a more serious careless driving or dangerous driving penalty, depending on the circumstances *Present penalty. The Government has announced that it plans to increase the penalty to 4pts and £150 AA Advice on mobile phone use Using a phone in a car • Don't use a mobile phone held in the hand while driving or while stopped with the engine switched on – it is illegal. • Stop to make or take a call or text message, or leave it to go to voicemail – even if you have a hands-free phone. • If you must talk and are using a hands-free phone, keep conversations short and simple or say that you will find a safe and legal place to stop and phone back. Calling someone's mobile If you call someone and think that they might be driving, ask them: • ‘Are you driving?’ • ‘Are you hands-free? Is it safe to talk?’ If they are obviously driving and trying to continue the conversation it’s OK to say: • ‘I’ll call you back later’ / or: ‘Call me when you have stopped’ and ring off |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.