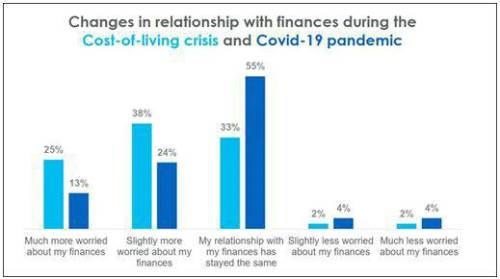

Aegon research tracking adults’ relationship with their finances since the start of the covid-19 pandemic has found that financial worries are already significantly worse since the beginning of the cost-of-living crisis* than experienced during the pandemic.

The latest research shows nearly two thirds of adults (63%) said they are worried about their finances during the cost-of-living crisis. This compares to 37% of adults who said they had financial worries during the pandemic.

Aegon research, August 2022 and October 2020. 2,000 adults

The research found money worries are being felt fairly consistently regardless of household income. While lower income households may be least resilient, concerns are not limited to any wealth band.

However, there is a notable difference when looking at the gender split. 7 in 10 (69%) of women said they are worried about their finances during the cost-of-living crisis, compared to 56% of men.

Of those with money worries, a quarter (25%) are just concerned about their short-term finances and 27% are just concerned about their long-term finances. But in addition to this, nearly half (45%) are concerned about both their short-term and long-term finances.

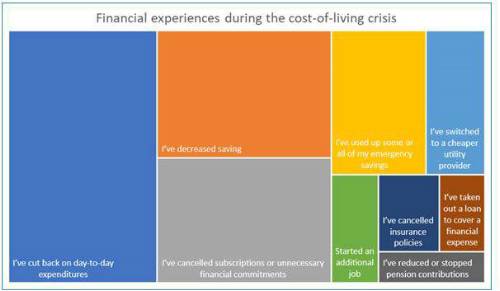

Financial experiences during cost-of-living crisis

The research also looked in more detail at the experiences of adults who admitted to having money worries. Since the start of the cost-of-living crisis over half (54%) have cut back on day-to-day expenditure while a third (31%) have cancelled subscriptions or unnecessary financial commitments. This could include products such as a TV or music streaming services.

However, while these are positive steps to help lower daily expenditures, the research also points to a rise in the number of people who have cut back on the amount they save and have dipped into their financial reserves. Nearly a third (32%) of those with money worries have decreased the amount they save and a fifth (20%) have used up some or all of their emergency savings. However, on a more positive note, only one in twenty (5%) have reduced or stopped contributions to their pension.

Aegon research, August 2022, experience of those with money worries. 1,260 adults

Steven Cameron, Pensions Director at Aegon, comments: The coronavirus pandemic caused huge social and economic turmoil, affecting our lives in different ways. However, when focusing on the impact on personal finances, there were significant disparities, with some seeing their income fall while others were unaffected and could even build up their financial resilience as expenditure reduced.

“Unfortunately, as we started to get back to normal after the pandemic, we’ve been hit by the worst cost-of-living crisis in most people’s living memory. The research shows money worries now are even greater than during the pandemic. Many of our most vulnerable will face the greatest challenges with some already affected financially by the pandemic now being hit again by soaring inflation. But as prices rise throughout the economy, individuals across the income spectrum are concerned and feeling the squeeze.

“Our research shows many are already taking action to cut costs by reducing day-to-day expenditure and cancelling unnecessary commitments. But worryingly, the research also points to a decrease in saving rates. While this may be unavoidable, it could have long-term implications on financial resilience. And when it comes to your pension, reducing or stopping contributions could mean missing out on employer contributions and having thousands less in funds to get by on in retirement.”

Steven Cameron continues on the steps to help combat money worries: “There are a number of ways to get help with financial concerns and it’s important individuals make use of these in order to build their financial wellbeing. The government offers free guidance via a number of online services such as MoneyHelper and financial services providers may also offer support and tools to help with your financial worries. A financial adviser can provide more personalised advice.

“While support services can’t always solve a shortage of ‘money’, they can improve people’s mindset by giving them some comfort that they’re taking the best steps they can in often very difficult circumstances.”

|