♦ Almost a quarter of 65-74 year olds are still earning a wage

♦ Over 55s' spending falls year-on-year as people prioritise household budgets

♦ Long-term retired turn to savings to maintain living standards

The UK's over-55s are increasingly working past the traditional retirement age as larger numbers fall back on their savings in later life to meet living costs, according to Aviva's latest Real Retirement Report.

The report examines the financial pressures faced by the UK's three ages of retirement: 55-64s (pre-retirees), 65-74s (the retiring) and over-75s (the long-term retired).

Prolonged working boosts income:

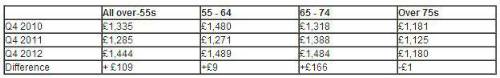

Average monthly income for the over-55s has increased by just £109 in the last two years (from £1,335 - Q4 2010 to £1,444 - Q4 2012). The retiring have driven this trend, gaining £166 overall, while monthly incomes have risen a mere £9 for pre-retirees and fallen by just £1 for the long-term retired (see table below for details).

The income boost for the retiring has been driven by more people working past the Default Retirement Age, which was phased out in 2011. Since the Real Retirement Report launched three years ago, the percentage of this age group who list wages as part of their income has risen from 18% to 23% (Q4 2012).

The report also shows the growing importance of workplace benefits in retirement. With the effects of auto-enrolment yet to kick in for future generations, people aged 65-74 (47%) are still more likely to draw income from an employer pension than those aged 75 and over (37%).

Expenditure:

Monthly spending by the UK's over-55s has actually fallen in the last year, despite annual inflation of 2.74% (Q4 2012), with average outgoings of £1,231 in Q4 2012 down from £1,269 in Q3 2012 and £1,300 in Q4 2011.

The typical over-55 has cut back on non-essential items and prioritised debt repayment, travel, and fuel and light. Spending on entertainment, recreation and holidays has fallen by 19% in the last quarter, while clothing and footwear has dropped by 13% and leisure goods by 10%. Meanwhile, spending on debt repayment has increased by 8% and almost matches monthly food bills (£177.58 compared with £189.45).

Savings:

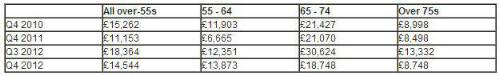

The average saving pot for over-55s has fallen by almost £4,000 in the last quarter (£14,544 - Q4 2012 compared with £18,364 - Q3 2012). This remains larger than a year ago (£11,153 - Q4 2011), but while pre-retirees' savings have reached their highest level since the report began, total savings have decreased among the two older age groups, both in the last quarter and in the last two years (see table below for details).

The need for the long-term retired to dip into their savings to maintain their standard of living has seen the percentage with less than £2,000 saved grow from 23% (Q3 2012) to 30% (Q4 2012).

In addition, saving rates are actually down by 28% from Q1 2012 although they have increased marginally year-on-year (up 7% in Q4 2012 compared to Q4 2011). The typical over-55 puts away just £28.67 or 1.99% of their monthly income: a mere £1.77 more than the same time last year.

Clive Bolton, managing director of Aviva's At Retirement business, comments:

"Whether it's through choice or necessity, the fact that people are working for longer shows how vital it is to work hard to achieve financial stability, so you can enjoy your retirement without the constant worry about making ends meet.

"The growth of income among the retiring population is a clear sign they are taking the opportunity to prepare for the future, and prioritise their outgoings to clear existing debts. And while the long-term retired may find their savings dwindle in retirement, it's important to remember that, with the right advice, there are often alternative ways to cope with rising living expenses and unforeseen costs."

Click here to view the full report

|