Market volatility has prompted more than half (56%) of professional trustees of DB pension schemes to change their funding target in the last 12 months, according to new research from Charles Stanley Fiduciary Management.

The annual research, which polled 68 professional DB trustees appointed on schemes with an average AuM of £1.38bn, sheds a light on sentiment and decisions made by professional trustees on DB pension schemes.

Long-term funding targets

Almost two in five (39%) of trustees have long-term funding targets set. While trustees of DB pensions schemes are clearly making headway in terms of their funding targets - this is a significant increase on 2022, where just 24% had targets set - a high number are still yet to set theirs. With upcoming regulatory requirements in place to ensure long-term funding targets are set, this will be a priority for trustees to finalise. 37% of professional trustees say that while a long-term funding target has not yet been set, they expect to do so within the next 12 months, while 21% expect to do so within the next 12-24 months.

Looking at what those long-term funding targets are, or are likely to be, self-sufficiency was the top choice (43%), followed equally by buy-out via an insurer (28%) and superfund consolidation (28%). 2% had not yet decided. Notably, buy-out via an insurer has become a less popular avenue for professional DB trustees, with last year’s research finding 34% of trustees had their long-term funding target set as this.

As the UK has experienced significant market volatility this year, including a high inflationary and interest rate environment, many trustees have had to reconsider their long-term funding targets. According to the research, there has been a fall through of the superfund system, with 44% of professional trustees revealing they moved away from superfund consolidation. 28% said they’ve moved away from buy-out as their long-term funding target, while 28% said they moved away from self-sufficiency.

While trustees set their funding long-term funding targets, if they are to achieve them, trustees need to ensure their investment strategy is laser-focused on reaching that target, and to adjust their risk appetite accordingly.

Risk appetite

There is a steady trend of professional DB trustees’ overall appetite for investment risk increasing, with 75% saying it grew over the last 12 months. This compares to 69% who said the same in 2022, and 47% who said their overall appetite to investment risk increase in 2021.

Asking trustees about their risk appetite on specific asset classes, interest rate hikes have brought an increased appetite for interest rate risk. Indeed, 81% of trustees confirmed their appetite for interest rate risk has increased over the last 12 months. Inflationary appetite has also continued to climb for DB trustees, with 75% saying their appetite for inflation risk has increased over the last 12 months.

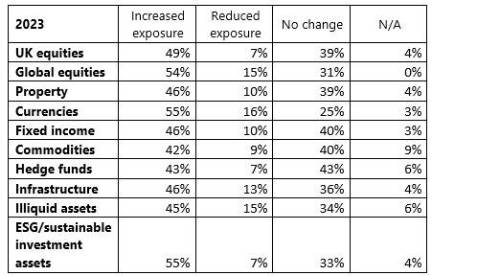

A number of trustees have also adjusted their scheme's exposure to certain asset classes in the last 12 months, with 54% confirming they’ve increased exposure to global equities, while 46% said the same about fixed income.

Bob Campion, Senior Portfolio Manager, Charles Stanley Fiduciary Management comments: “It is reassuring to see that trustees are making good progress towards setting formal long-term funding targets, even though the timescale for the regulatory requirement to do so keeps getting pushed back. We have been encouraging our clients to have informal long-term targets for the purpose of their investment strategy for over a decade now!

“The increased focus on buyout, ahead of superfunds and self-sufficiency, is not surprising as buyout deficits have fallen across the industry. We’ve seen many clients move into our buyout aware strategies, keen to take advantage of the higher yields now available. I have no doubt this trend will continue.

“The desire of trustees to take more investment risk is perhaps at odds with the trend towards focusing on long-term targets and buyout. For most schemes, reducing risk rather than increasing it is more likely to be the order of play, especially with the yields available on low risk assets now much higher than any time in the last decade. This is a trend playing out across the institutional investment landscape; as ever, a diversified multi-asset approach is a worthwhile focus."

|