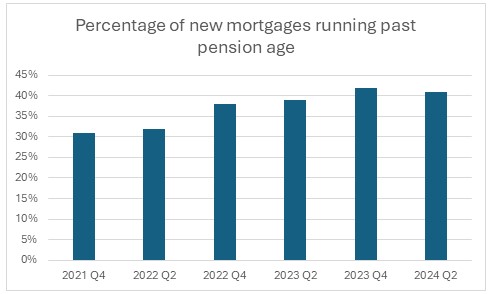

The latest data, obtained by LCP partner Steve Webb, shows that in the most recent quarter for which data is available (Q2 2024), just over 2 in 5 of all new mortgages had terms which run past pension age. This compares with barely 3 in 10 new mortgages at the end of 2021.

The chart shows the percentage of new mortgages set to run past pension age in alternate quarters from Q4 2021 onwards.

In total it is estimated that over a million new mortgages have been issued since the end of 2021 with terms running past pension age.

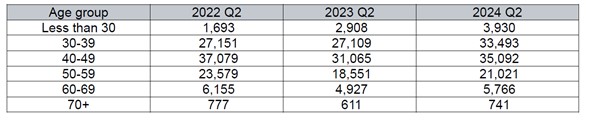

In terms of the ages of people taking out these very long mortgages, the table below gives the age breakdown for mortgages running past pension age taken out the second quarter of 2022, 2023 and 2024:

Over the last two years (from 2022 to 2024), the growth in new long-term mortgages seems to have happened primarily at younger ages, with a 30% increase in the absolute number of under forties taking out mortgages set to run into retirement.

One reason for these exceptionally long mortgage terms may be affordability, with younger borrowers opting for extended terms in response to high interest rates. However, despite mortgage rates now seeming to be on a downward trajectory, the proportion of new mortgages with these long durations remains at around 2 in 5.

Commenting, Steve Webb, partner at pension consultants LCP said: “There is increasing evidence that taking out a mortgage which runs past pension age is an entrenched feature of the mortgage market rather than a temporary blip. This has profound implications for retirement planning, as it is likely to mean that savers may end up using up already inadequate pension pots to clear a mortgage balance. Anyone involved in helping today’s workers plan for their retirement must now factor in the possibility that housing costs will run into retirement or will have to be funded from already meagre pension pots”.

|