Most UK adults lack confidence that the State Pension will exist at its current value when they come to retire, new research by retirement specialist Just Group reveals.

With the State Pension set to rise by more than 10% this week, a survey of 2,000 UK adults reveals that 55% are not confident its value will be maintained by the time they start to claim, compared to 32% who were confident it would keep up with inflation.

The findings come amid concerns about the affordability of the ‘triple lock’, the government

promise to increase State Pension by the higher of inflation, average wage growth or 2.5%.

“The government’s announcement not to bring forward a rise in State Pension Age has once again focused attention on the long-term viability of the triple lock and the cost of the State Pension to the public purse,” said Stephen Lowe, group communications director at Just Group.

“Our research shows most people are sceptical that when they get to retirement the State Pension

will hold the same buying power it does today.”

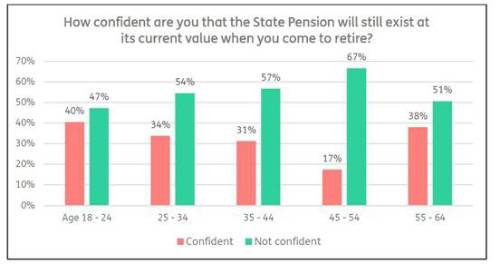

At all ages, a higher proportion of adults thought the value of the State Pension would fall before they retired than thought its value would be maintained.

The 45-54 age group was least confident that the value of State Pension would be maintained. The age groups closest (ages 55-64) and furthest (ages 18-24) from retirement were the most confident the value would be maintained, but were still outweighed by those who were not confident.

Women were significantly more likely to be pessimistic about the State Pension’s value with just

one in five (22%) thinking it would hold its value compared to four in 10 men (41%).

“Under current law, the government is only obliged to increase the State Pension by the rise in average earnings which would mean its value might erode during periods of high inflation,” said Stephen Lowe. “The 2023-24 rise, for example, would have been 5.5% had the rise in earnings been applied but by sticking to the ‘triple lock’ it has actually been increased by the 10.1% rate of inflation.

“The government has only guaranteed the ‘triple lock’ until the next General Election and may not be able to resist tinkering, as was the case in 2022-23 when the triple lock was suspended post- pandemic. The ‘triple lock’ has successfully lifted many low-income pensioners out of poverty but there are some that view its days as numbered due to the cost.”

He said that chopping and changing pension policy makes it more difficult for people to plan over the long-term for retirement.

“In recent weeks we have seen private pension saving allowances being changed quite significantly with the opposition party saying these changes would be reversed, as well as the government delaying a decision on when and how State Pension age may rise to 68,” he said.

“The message for pension savers is to take control of the process as much as you can and put in place your own financial plans.

That may require taking professional advice or finding ways to save more, but it will help insulate you from future government decisions that may damage your plans.”

|