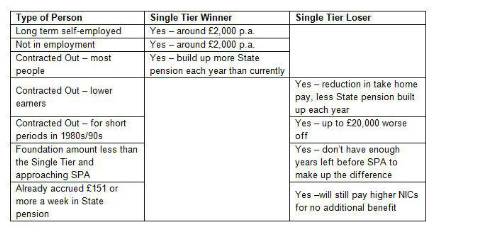

• Less than half those reaching State Pensions Age (SPA) shortly after 2016 will earn full single tier pension of £155 per week

• Most people will lose out over the long term with less scope to build up a more generous State pension due to a cap of 35 years on accruing this benefit

• The winners will be the long term self-employed and those not in employment who will generally be £2,000 p.a. better off under the new system

• Majority of individuals who have been contracted out will be winners as from April 2016 they will build up more state pension each year than they do currently

• For those that have been contracted out, there are two groups who will lose out

• Lower earners currently receive a State pension top up. From April they’ll pay higher National Insurance Contributions, seeing an equivalent reduction in take home pay, but build up less State pension each year

• People who were contracted out for short periods in the 1980s/early 1990s could be worse off to the tune of £20,000 over their retirement

• Other losers include those whose foundation amount is less than the Single Tier and who don’t have enough years left between now and SPA to make up the difference

• Those who have accrued more than £151 will not be able to accrue any more State pension after April 2016, but may have to continue paying higher NICs for no benefit

With the new Single Tier State pension less than 6 months away, new analysis from Hymans Robertson indicates the scale of complexity that will still exist in the system. The result will be a system of winners and losers to the tune of thousands of pounds:

Explaining why the move to ‘simplify’ state pensions is fraught with complexity, Sue Waites, Partner at Hymans Robertson, said:

“There’s a widespread expectation that everyone who reaches state pension age from April 2016 will move from a basic state pension of £115 to a new flat rate of £151 per week. The reality is quite different. The transition to the new State pension brings many complications, particularly for those approaching State Pension Age (SPA). Some will be very surprised at how much they actually get.

“The introduction of the Single Tier pension is hailed as an exercise of simplification, but working out who the winners and losers are is horrendously complicated. The picture is far from clear, particularly for those who are currently close to SPA. These individuals should get in touch with the DWP to find out what they’re likely to receive and avoid unpleasant surprises.

“Over the long-term, broadly speaking, the majority will lose under the new State pension. Under the current regime, although basic state pension accrual is limited to 30 years, additional State pension can be accrued over an entire working life (potentially up to 50 years). Under the new system it will be capped at 35 years with no additional State pension so there will be less scope to build up a more generous entitlement.

“The only people who won’t lose over the long-term are those who don’t accrue additional State pension at the moment. Typically these are the self-employed or not in employment who are not entitled to credits towards additional State pension. Generally they will receive a higher State pension from the new system. They’ll effectively be £2,000 pa better off as currently they’ll only be accruing Basic State Pension.

“However, the biggest issues lie with those approaching retirement. The picture here is incredibly complicated due to the way in which your entitlement is worked out in April and then beyond. Essentially it’s a transition issue.

“There are three categories of losers. The first are those whose foundation amount is less than the full Single Tier and who don’t have enough years left between now and SPA to get up to the full Single Tier level.

“The second is those who have accrued more than the Single Tier amount. This group will lose under the new system as they’ll continue to pay more NICs for no additional benefit. These individuals may currently be accruing additional State pension but will not build up anything further from April 2016.

“The third group is those who were contracted out for a short period in the 80’s / early 90’s. A relatively short period of contracted out service can result in a far bigger deduction from the foundation amount than the individual may be expecting. Some people in this category could be as much as £20,000 worse off over the course of their retirement.

“The DWP has been a bit slow off the mark in bringing these issues to the public’s attention. It’s good to see Baroness Altman going on a crusade recently, and we hope it will provide individuals with much needed support to help them understand what pension they will ultimately receive from the State.”

|