In November, Royal London published a policy paper entitled ‘Mothers Missing out on Millions’ which highlighted the way in which mothers in higher income families were giving up claiming child benefit. This was because of the introduction in January 2013 of the ‘High Income Child Benefit Tax Charge’, a rule which means that couples where one partner earns more than £60,000 per year have the value of their Child Benefit wiped out by a tax charge. In response to this, growing numbers of mothers starting a family since January 2013 have declined to claim Child Benefit at all. But this means they are missing out on vital National Insurance credits towards their state pension. Each year missed could cost 1/35 of the value of the state pension – around £231 per year or over £4,600 over the course of a typical 20 year retirement.

Friday’s figures show that this problem is growing. Key findings include:

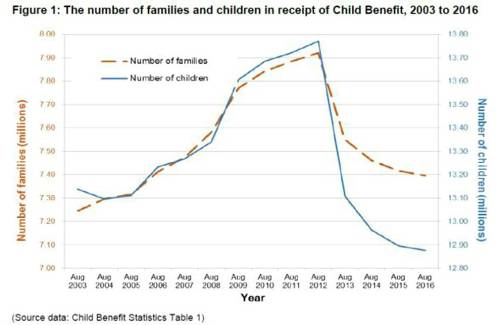

Prior to the 2013 changes, the number of families receiving child benefit had risen every year since 2007; since then, the number has been falling; HMRC themselves say: “The number of children for whom Child Benefit is being paid is now at its lowest level since HMRC began producing these statistics (in 2003)”.

The impact of the changes is shown in the graph which comes from the HMRC report:

Based on the new report, Royal London estimates that the number of mothers missing out on vital credits towards their state pension has more than doubled in the last two years and now stands at around 50,000.

A woman who started her family in early 2013 and decided not to claim Child Benefit could have missed out on state pension credits for five years so far – 2012/13 to 2016/17 inclusive. The total loss over those five years could be 5/35 of a state pension or over £1,000 per year in retirement. Over the course of a twenty year retirement, such women could be more than £20,000 worse off in total. Worse still, as things stand, Child Benefit claims can only be backdated for three months so they will never recover the lost pension rights.

Commenting, Steve Webb, Director of Policy at Royal London said: “Tens of thousands of mothers with young children are missing out on vital state pension rights. This risks setting back the cause of equality for mothers by a generation. HMRC were alerted to this problem last year and have done nothing about it. These new figures are a damning indictment of a system that is no longer working for families. The Government needs to take urgent action to ensure that mothers get the pension protection to which they are entitled”.

|