WTW has warned that UK motor claims inflation is expected to accelerate in 2022. Analysis by WTW indicates that a slowdown in the average time taken to settle claims, due to disruption caused by the pandemic, has until recently acted as a temporary brake on claims inflation.

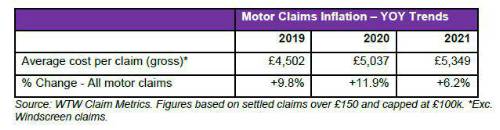

Motor claims payout inflation increased by over 6% during 2021, taking the average cost per claim (ACPC) to £5,3492, according to WTW’s latest Claim Metrics benchmarking data3. However, a combination of rising accident frequency after the pandemic lull, surging global inflation, elevated used car prices, and ongoing supply chain constraints pushing up repair costs, is likely to force a sharp correction in 2022.

Tom Helm, Head of Claims Consulting at WTW, said: “The fall in motor insurance claims during the pandemic has been widely reported, but less well understood is the bottleneck of bodily injury claims that are taking insurers longer to process due to issues such as delays in medical reports.

“It has inevitably been a challenge for injured parties to be examined and treated due to COVID-19 restrictions and this has led to claims processing times taking longer than at any point over the previous four years. This delay in bodily injury settlements meant that settlements in 2021 had a distinct bias to lower cost ‘vehicle damage only’ claims, temporarily preventing a sharper spike in claims inflation.”

The average claim settlement time slowed down from April 2020 during the first lockdown. By the final quarter of 2021, the process was taking two months longer compared to the same period in 2019. Settlement time for bodily injury claims have been most impacted, increasing by seven months on average and now taking over two years to complete.

Other findings from the latest Claim Metrics benchmarking data:

• London now takes the top spot from the North West as the region with the highest average cost per claim (ACPC), at £6,189 in 2021.

• The South West - helped by being the region with the lowest average claimants per claim – records the lowest ACPC in 2021 at £4,497 some £1,700 below London.

• The sharpest rise in claims inflation took place in the East of England, which has now risen by 23.6% between 2019 and 2021.

• SUVs felt the full force of soaring second-hand car inflation, with the cost of replacing a customer’s stolen large SUV increasing by 28% between 2020 and 2021.

• The cost to insurers to settle a customer’s vehicle accidental damage claim has increased by 20% between 2019 and 2021.

• Claim volumes in 2021 varied between regions. London figures remained considerably down compared to 2019 levels, whereas the North West saw volumes during the second half of last year increase by 16% in some months compared to the same period in 2019.

• ‘Hit in rear’ claims, historically the most common motor claim type, remained down in second place in 2021, with ‘hitting a parked stationary car’ retaining the top spot. Hitting a vehicle in the rear is almost twice the cost of hitting a parked stationary car. This will be a trend to monitor in post-lockdown claim volumes.

Tom Helm said: “Since the whiplash reforms went live on 31 May 2021, the new process has reportedly faced a number of teething problems, exacerbating the slowdown in injury settlement times. However, there are signs a lower average cost is starting to materialise for whiplash claims. Assuming this trend continues as a wider distribution of tariff cases settle via the portal as it matures, the reduced frequency and cost of these whiplash claims should help to offset some of this year’s increase in settled spend that will inevitably flow from the delayed settlement of severe injury claims that have occurred during the last two years.”

1 Statista. Link: https://www.statista.com/statistics/270384/inflation-rate-in-the-united-kingdom/

2 Claim Metrics data is based on claims between £150 (£500 PI) and £100,000, excluding windscreen claims.

3 Claim Metrics data for 2021 relates to claims settled between 1 January 2021 and 31 December 2021.

|