By Fiona Tait, Business Development Manager, Royal London Group

In one of the shorter statements in his speech, the Chancellor simply announced that the Money Purchase Annual Allowance will be reduced to £4,000 from April 2017.

There is a consultation, ‘Reducing the Money Purchase Annual Allowance’, which asks for responses by 15 February 2017 on the legislative changes. However, the speech contained the clear direction that “the Government does not consider that earners aged 55 and over should be able to enjoy double pension tax relief”. In other words, the consultation is more about how to implement the change, than whether it should happen.

The consultation document does flag the one issue that could potentially have a huge impact and that is the knock-on effect on the successful roll-out of automatic enrolment. Aside from that, the only concessions we are likely to see are possible exemptions for those who “genuinely need, rather than simply choose, to draw on their savings”. These are expected to be isolated cases, which might include circumstances such as redundancy, divorce or bankruptcy.

Who will be affected?

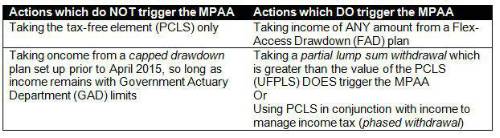

Apart from anything else, the changes to MPAA adds an unhelpful complexity to pension planning. The MPAA is triggered the first time an individual withdraws taxable income from a Defined Contribution (DC) pension plan. Therefore:

I would strongly recommend that pension scheme members who are thinking of withdrawing money next year should speak to an adviser and consider the consequences before they do so.

The Consultation document does not distinguish between those who trigger the MPAA after April and those who have already taken this irrevocable step in the belief that they would still be able to save £10,000 a year. Royal London will certainly be arguing that the existing allowance should continue to apply to individuals in this situation. However, we would also recommend that advisers and their clients consider making full use of the existing limit before 6 April next year, if they can.

So what?

The actual number of individuals affected, at least in the short term, by the change will be very low. The Government believes only 3% of individuals aged 55+ make DC contributions of more than £4,000 a year, and the current level of the MPAA is “more than three times median DC contributions made by men aged 55+”.2

The concern is, that while a very small proportion of this age group might still be saving, a much higher proportion almost certainly should be, and at much higher levels.

It is not reasonable to assume that the majority of people in this group will have already funded their retirement sufficiently by 55 and in addition, not sufficiently so that £4,000 a year will be enough to top up their savings to replace any early drawdown of income or tax free cash.. Fifty-five is not the age that most people retire. Indeed the Government has been clear one of the ways it intends to manage the cost of longevity is to encourage more flexible retirement patterns and extended working lives. There should be some reward for those who continue to work and to save for their future and not impose restrictions on them to save.

|