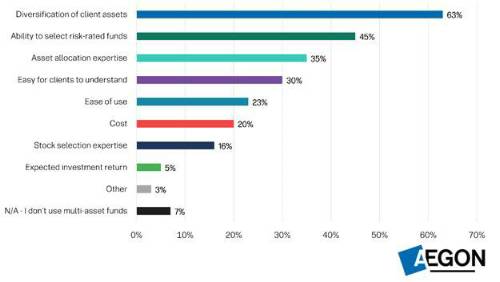

63% of advisers recommend multi-asset funds for their diversification, followed by risk-rated fund selection (45%) and asset allocation expertise (35%).

60% of advisers would recommend multi-asset funds to clients with less than £100,000 to invest, while 37% of advisers would recommend portfolios from discretionary funds managers (DFMs) to clients with over £500,000 saved.

More generally, almost two-thirds (63%) of advised assets now utilise outsourced solutions, such as multi-asset funds, DFMs or model portfolios built using external expertise.

Findings from Aegon’s latest Adviser attitudes report show a number of new and continued trends within investment advice, collating the responses of 200 financial advisers to paint a comprehensive picture of an ever-evolving industry.

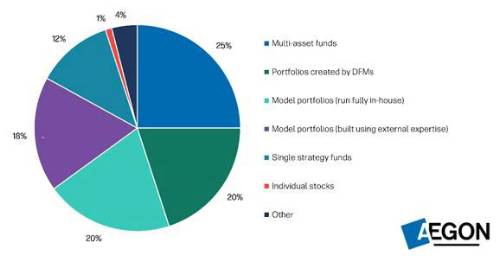

The research shows that multi-asset strategies are the top investment choice recommended by financial advisers, with 90% of surveyed advisers using them for both client accumulation and decumulation. Notably, the findings show that 25% of client assets are invested in such funds. In comparison, 20% of assets are invested in DFM portfolios, 20% in fully in-house model portfolios, 18% in externally built model portfolios, 12% in single strategy funds, and 1% in individual stocks.

Chart 1: Proportion of clients assets invested by type of investment structure

Data source: Adviser attitudes report, Aegon UK, August 2024. Question: If you use multi-asset funds, what are the main reasons you recommend this investment structure? Please select a maximum of three.

Of those who use multi-asset funds, the most common reason for recommending them is the diversification that they offer (63% of advisers). Advisers are also likely to recommend them based on the ability to select risk-rated funds (45%) and the access they provide to asset allocation expertise (35%).

Chart 2: Main reasons for recommending multi-asset funds

Data source: Adviser attitudes report, Aegon UK, August 2024. Question: If you use multi-asset funds, what are the main reasons you recommend this investment structure? Please select a maximum of three.

However, although the findings show that multi-asset funds are the most popular, the investment structure chosen by an adviser also depends on client circumstances and needs.

53% of advisers consider multi-asset funds to be the least expensive approach. Consequently, multi-asset funds are the most recommended structure for clients with less than £100,000, with 60% of advisers favouring this option. In contrast, 80% of advisers consider DFMs as the most expensive investment approach, while also being the most recommended structure for clients with more than £500,000 in savings, with 37% of advisers endorsing this option.

Moreover, advisers are increasingly turning to external solutions when managing their clients’ assets. Almost two-thirds (63%) of advised assets make use of such solutions, including multi-asset funds, DFMs or model portfolios built using external expertise.

Lorna Blyth, Managing Director, Investment Proposition, comments on the findings: “There’s no doubt that elevated market volatility has made the past three years an incredibly challenging and unpredictable period for investment advice. But, as we start to see a gradual return to normality, it’s encouraging to know that the majority of advisers are aligned and feeling confident in the strategies employed by their clients’ investments.

“In particular, our research shows advisers favour multi-asset funds as their primary investment structure, with 25% of all client assets under management in such funds. This is likely due to their considerable versatility and diversity, and the ability to select options that align to different risk appetites.

“Multi-asset funds, such as Aegon’s Risk-Managed Portfolios, also offer ease-of-use for advisers and customers, with the permission to make asset allocation changes over time on the customer’s behalf built into the fund design.

“In addition, they support advisers in meeting their regulatory obligations – such as MIFID II, PRIIPs and new Consumer Duty rules – with target markets’ pre-defined and robust investment governance processes built in.”

|