Exposure to international equities within the Skandia Spectrum range of risk targeted funds has been significantly increased in order to benefit from the higher growth expected in overseas economies.

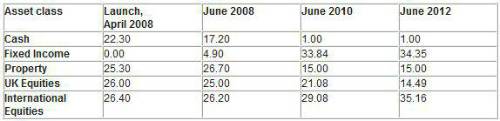

The most recent update of the strategic asset allocation* of the funds in Q2 2012, derived in conjunction with Towers Watson, saw exposure to international equities increase from 31.7% to 35.2% in Spectrum 5, hitting its highest ever level. At launch in Q2 2008 exposure to international equities stood at just 26% and two years ago in Q2 2010 it stood at 29%, demonstrating a steady increase.

The increased exposure to international equities has come at the expense of UK equities which saw their allocation drop from 17.8% to 14.5% in the latest asset allocation change in Q2 2012. At launch in 2008 exposure to UK equities was the same as international equities at 26%, but this had decreased to 21% by Q2 2010 and is now at its lowest allocation.

John Ventre, lead portfolio manager for the Skandia Spectrum funds, comments:

"We believe that the global economy is undergoing a significant and potentially generational period of rebalancing. The continued march of the emerging markets against what we currently call the ‘developed world' is not a short term issue with them now representing around a third of the global economy. We see this creating significant long term opportunities for investors and want to ensure that we are well placed to take advantage of this. When considering the equity component of their portfolios all investors should broaden their horizons and look to benefit from the faster growing economies in the world."

The Skandia Spectrum funds are a range of six risk targeted funds that are designed to deliver maximum investment returns for a given level of investment risk. The funds are managed to stay within their stated risk level so that investors can be confident that the funds remain aligned with the risk they are prepared to accept with their investment.

*The asset allocation detailed in this press release is for the Skandia Spectrum 5 fund. Overall there are six Spectrum funds that match Skandia's risk levels 3 - 8 on a scale of 1 - 10, with 1 being lowest risk. Skandia Spectrum 5 is the largest fund with £369 million funds under management, as at 31st March 2012. The asset allocation breakdown of the Skandia Spectrum 5 fund is:

|