A report by actuarial consultancy OAC (part of the Broadstone Group) reveals how healthcare protection from the mutual and not-for-profit sector delivers nearly £1 billion in cost savings for the nation – across the NHS, welfare state, employers and their employees.

Mutuality: supporting health and wellbeing in the UK highlights the benefits to employers and individuals, through the provision of health cash plans, private medical insurance and income protection policies.

The report collects its data from annual report and accounts, solvency and financial condition reports, information collected via surveys from the Association of Financial Mutuals and press releases including claim statistics to consider the benefits to:

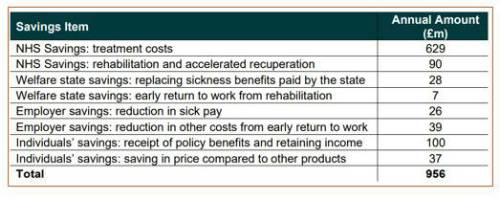

• the NHS in terms of savings in treatment costs, and rehabilitation and accelerated recuperation

• the welfare state in terms of savings from the replacement of sickness benefits paid by the state and early return to work from rehabilitation,

• employers through a reduction in sick pay and a reduction in other costs from early return to work,

• individuals through receipt of policy benefits, retaining their income and other benefits gained from being a member of a mutual or not-for-profit organisation.

It finds, for example, that in 2022, the report group paid claims of £629m in respect of healthcare treatments. A significant proportion of these claims, where the treatment is provided privately, represent direct savings to the NHS.

A further consideration is the impact of Insurance Premium Tax (IPT) in the figures above with OAC estimating that holders of health cash plans and private medical insurance policies covered by this analysis paid an extra £98m during 2022 due to IPT.

If IPT were to be abolished, then these policies would become more affordable and more attractive to individuals and employers alike. A 20% increase in take-up of these policies could potentially add a further £65m per year to the benefits shown above, even after allowing for the loss of IPT revenues to the welfare state.

Cara Spinks, Head of Insurance Consulting at OAC, commented: “With pressure on public health services like never before, this report provides a timely update on the valuable contribution to public health finances given by the mutual and not-for-profit sector.

“Through the provision of health protection policies to employers and individuals these long-standing organisations boast a strong heritage of protecting workers from the impact of ill-health, unemployment or old age.

These (many small) mutual organisations continue to operate effectively in the healthcare and protection sectors today. They do this by complementing the NHS and welfare state to actively support employers in helping their employees to remain healthy.

“We have estimated that cost savings to the NHS, welfare state and employers arising from the provision of health protection policies during 2022 by the group of organisations covered in our analysis to be almost £1bn. This demonstrates the very valuable, and sometimes overlooked contribution to public health services made by this sector.”

Access a copy of the report here - Mutuality: supporting health and wellbeing in the UK

|