By Hugo Gravell, Principal and Investment Consultant at Barnett Waddingham

We explore factors that have led to this concentration in global equities, differences compared to the tech bubble, and why our view on how to invest in equity markets is unchanged.

The Four Horsemen, FAANGs and the Magnificent Seven (M7)

When small numbers of stocks drive market returns, the financial press often provide a nickname. In the tech bubble it was the Four Horsemen (Microsoft, Cisco, Intel and Dell), in the 2010s it was the FAANGs (Facebook [now Meta], Apple, Amazon, Netflix and Google [now Alphabet]), today we have the M7 (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla).

The M7 represent seven of the eight largest listed companies in the world. All are US-based ‘big tech’ companies that have benefitted from increasing use of technology, including recent advancements in artificial intelligence (AI), even if not classified in the information technology (IT) sector. They have collectively generated around one third of global equity returns over the last two years.

Is this a repeat of the tech bubble?

There are similarities with the tech bubble, including:

Market speculation about significant future revenue growth from emerging technology.

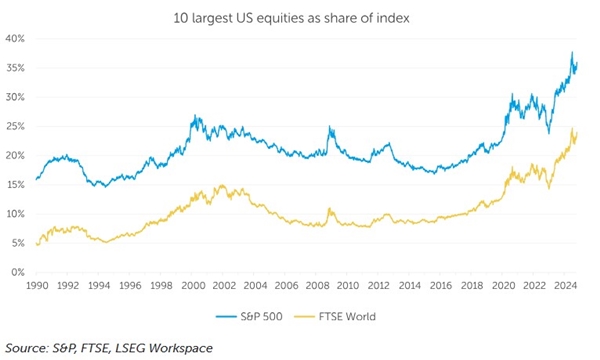

Equity market concentration in a smaller number of companies.

However, there are key differences. During the tech bubble many of the leading companies had enormous price-to-earnings (P/E) ratios. The Four Horsemen reached an average valuation of 66 times earnings as investors bet on profits rising rapidly. While internet usage did take off, it proved slower than expected, and so valuations proved unsustainable.

In the 2010s the FAANG stocks reached even higher P/E ratios, but this time earnings growth came through much quicker. Today, the M7 trade at 34 times earnings - closer to the tech bubble’s lows than its highs.

Is the market concentration justified?

Significant equity market concentration is not unusual, and not just in the US. The top ten stocks in the UK FTSE All-Share make up 41% of the index. The share of the largest US stocks in global markets is more unusual. However, we are confident this concentration can be justified by company and economic fundamentals.

The rise of the US

The US has grown much faster than other developed economies in recent years and this trend is forecast to continue. As most companies still generate an outsize proportion of their revenues in their home market, it’s not surprising that the US equity market has risen as a share of the global equity market.

Technology is a global industry

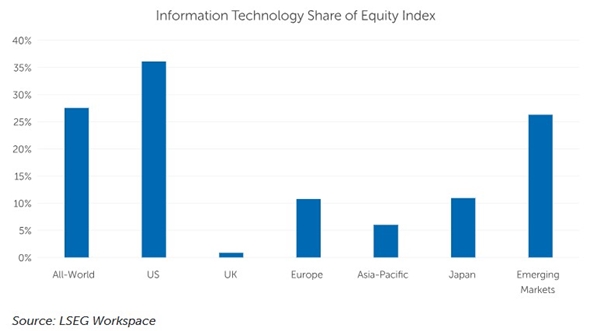

Technology companies find it easier to expand and benefit from growth in emerging markets, which has been even stronger than in the US. This is not unique to US companies, but other regions have a much smaller technology sector. This is partially because non-US companies have listed in America – including the semiconductor ARM, which started life in the UK and would be our fifth largest stock.

Emerging Markets are the only other region with significant technology exposure, notably Taiwan-based TSMC, the only non-US stock in the global top 10, and Chinese technology stocks. However, China's 2022 crackdown has slowed its tech sector compared to US companies.

Network effects and economies of scale

The big tech stocks derive significant benefits from their enormous scale, for example they can:

Benefit from network effects – Facebook, the largest social network with three billion monthly active users, attracts new users as they can connect with friends already on the platform.

Afford to purchase emerging competitors - Meta purchased Instagram and WhatsApp, now the third and fourth largest social networks.

Afford to diversify away from their core businesses – Amazon Web Services is the largest cloud computing service provider, and its Prime Video brand earns more revenue than Netflix.

Use data access to their advantage in research and development – AI development relies on access to data and the M7 make up 40% of the S&P 500 expenditures on research and development.

Is there a risk to this concentration?

Companies can fall victim to poor management or changing markets, and governments can intervene to increase competition. Even one M7 company falling victim to such risks would have a significant impact on market returns. There risks can be mitigated by investing in equally weighted indices or in equity indices weighted to favour smaller companies. However, these options likely lead to reduced performance and greater volatility than the market due to greater exposure to smaller, less liquid stocks.

Balancing market exposure and market concentration risk

Our view when investing in equity is therefore unchanged - a starting point of investing in the market benefits from the collective wisdom of investors all around the world.

That’s not to say that markets are always fairly priced. Our Megatrends note outlines areas where controlled moves away from equity indices could create long-term benefits, such as climate risk.

For equity investors wishing to diversify from big tech or tap into megatrends, we recommend a satellite approach. However, a more effective approach would be to widen your opportunity set by exploring private markets or considering downside protection.

Callum Smith, Lead Investment Research Specialist, contributed to this blog.

|