Research from retirement specialist Just Group’s Countdown to Retirement survey reveals that approximately two-thirds of over 55s retired before reaching the State Pension Age, which currently stands at 66.

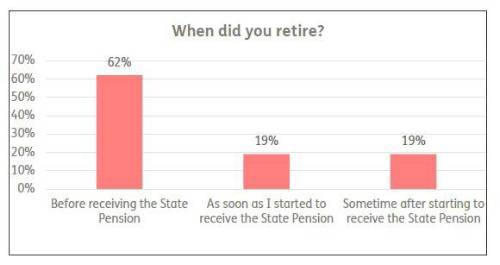

More than six in 10 (62%) of the 1,050 retired over 55s surveyed left the workforce before receiving their State Pension. A fifth (19%) stated that they retired as soon as they started to receive the State Pension, and the same proportion (19%) claimed they retired sometime after receiving the State Pension.

Male retirees (69%) were more likely than their female counterparts (55%) to retire before the State Pension.

Over a third (34%) of those who retired before they reached State Pension Age said that they also withdrew money from their pension between the age of 55 and finishing full-time work, highlighting widespread use of pension cash by many people yet to give up work.

Meanwhile, data from the FCA’s Retirement Income market update raised concerns about the sustainability of income withdrawals.

It found that 40% of income drawdown plans were being withdrawn at an annual rate of 8% or over, with 13% seeing regular withdrawals of 6-7.99%.

Commenting on the research, Stephen Lowe, group communications director at retirement specialist Just Group, said: The majority of people are retiring before they reach State Pension Age, putting extra pressure on their retirement finances because they must bridge the income gap between stopping work and starting to receive the State Pension.

“Unsurprisingly, our survey also discovered high levels of early pension access with nearly three in 10 (28%) taking money out of their pension before retiring, rising to more than a third of those who stopped working before State Pension Age.

“The majority of people using income drawdown strategies are extracting more than 6% a year, substantially higher than benchmark so-called ‘safe’ rates of closer to 3-4% exacerbating concerns about how long people’s pension income will last.

“We would urge people approaching the age when they can access their pension, and those thinking about when they can afford to leave the workforce to seek help before making irreversible decisions.

“Seeking support from a professional financial adviser remains the gold standard, however, making an appointment with free, independent and impartial government guidance service Pension Wise can give people a good understanding of their options.”

|