The firm has modelled the likely level of inflation over the coming months based on three economic scenarios – whether the economy is ‘stuck in the doldrums’, ‘steady as she goes’ or enjoying a ‘bounce back’. Unless there is a strong recovery in the economy, the firm finds that CPI inflation could be negative in September and could even be as low as -2.8%. RPI inflation would also be expected to go negative under some of these scenarios. September is often a key month for measuring inflation for pension scheme purposes, as it can affect annual pension uprating for the following year.

Negative inflation is a particular issue for pension schemes because pensions in payment cannot be reduced, even if inflation is negative. This means that negative inflation creates a ratchet effect for pension increases that in turn means that, in the medium term, pensions can now be expected to increase by more than inflation, which is a higher cost than has been budgeted by schemes.

For example, LCP forecast RPI to be -0.8% with a ‘steady as she goes’ recovery. With around £800bn in index-linked DB benefits in payment in occupational pension schemes, a 0.8% increase in the real cost of benefits could represent a £5bn+ hit on schemes and their sponsoring employers.

CPI inflation has already fallen sharply from 1.5% in the year to March 2020 to 0.8% in April 2020. A further fall is expected when the inflation figure for May 2020 is published later this week.

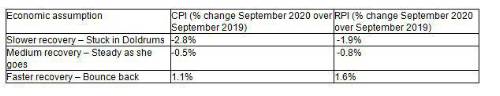

LCP estimates that future inflation rates will depend on the strength of the economy but could be as shown in the table:

The impact on individual schemes will depend on factors such as the extent to which indexation of pensions in payment is linked to inflation, the reference month within the scheme’s rules that is used to assess pension increases, and the approach taken to hedging the pension increases.

Commenting, Jonathan Camfield, partner at LCP said: “Ultra low interest rates and market volatility has already weakened the funding position of many schemes, but negative inflation could add a further financial burden. Schemes generally cannot reduce pensions in payment even when prices are falling, resulting in a real-terms increase in the cost of providing pensions. We anticipate that this could add at least £5bn to long term scheme costs and the burden on their sponsoring employers as deflation is expected to be experienced in the economy over the coming months”

|