• 56% believe BREXIT would be ‘quite’ or ‘very’ negative on their pension fund portfolios

• Over half cite impact of uncertainty as a top concern

• 70% predict increase in costs for their corporate sponsor in the event of a ‘leave’ vote

According to new EU Referendum research from mallowstreet, the biggest concern for the UK pension industry is that a ‘leave’ vote would cause negative portfolio returns and result in a prolonged period of uncertainty.

This latest survey from mallowstreet, the platform bringing the institutional pensions industry together to help solve the pensions and savings crisis, was conducted towards the end of May with a diverse group of pension professionals from its 3,000-strong community of key stakeholders.

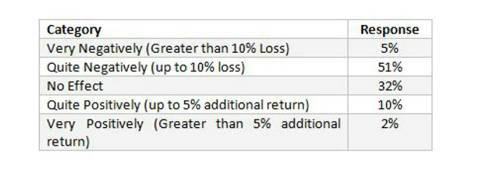

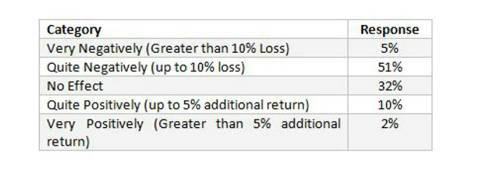

With two weeks to go until the Referendum on the 23rd June, these survey results underline how this concern over potential market events is playing out. When asked how they think Brexit will affect their scheme’s investment portfolio, 1 in 2 (51%) believe any resulting impact would be quite negative, predicting up to 10% loss on the assets in their portfolio, while 5% believe their portfolios would suffer a loss greater than 10%. 1 in 10 (10%) predict a positive impact (potentially generating 5% additional returns), and a third (32%) foresee no impact.

Table 1: How do you think BREXIT will affect your scheme's investment portfolio?

In terms of key investment concerns, respondents were asked to highlight their top three. Once again, top of the list is market volatility, with 1 in 4 (26%) citing this as a concern, next is political uncertainty (21%), followed by exchange rate volatility (18%).**

This latest survey from mallowstreet follows research on the EU Referendum in May, which found that 3 out of 5 solutions providers, trustees and consultants said that they wanted to remain in the EU.

Stuart Breyer, Chief Executive Officer, mallowstreet said: “What is clear from this second survey is that the industry is in limbo and will remain so until the results are announced. Only then, if we end with a Brexit, will we see the real impact.

Anything else is impossible to predict, which is not a comfortable position for trustees and sponsors to be in when making crucial long-term planning decisions around their pension fund’s investment strategy.”

|