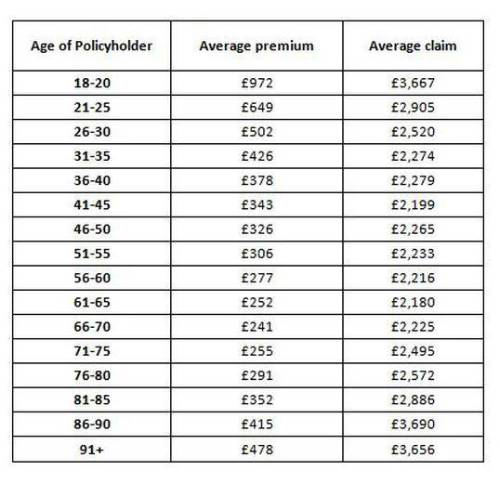

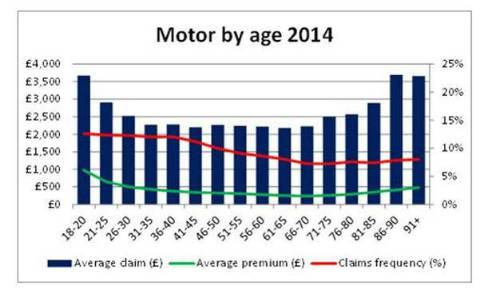

The data shows the average premiums that customers of different age groups pay for their car insurance, compared to the cost of the average claim they make.

Younger drivers between 18-20 years pay the highest average premium of £972, because their claims are likely to be expensive, an average of £3,667, and more frequent than other age bands. The group with the cheapest average car insurance premiums are 66-70 year olds who pay £241, since the cost of their average claim is relatively low at £2,225.

This data shows that in general drivers aged over 70 pay higher premiums than those in their middle age because they are more likely to make more expensive claims. Drivers aged over 90 pay an average premium of £478, because the cost of their average claim is £3,656, almost 50% higher than those who are twenty years younger. However, these older drivers pay less than those in their late twenties, who pay an average of £502.

The ABI’s average motor insurance premium tracker for Q1 2015 shows that the average premium for all age groups is £360, which has fallen by 5% over the last two years. Drivers aged 86 and over only pay 15% more than this.

Rob Cummings, Manager for General Insurance at the ABI comments:

“This data shows the clear link between the age of a driver and the risk of making an expensive claim on a car insurance policy. Older and younger drivers will pay more for their car insurance than those in their middle age because they are more likely to have accidents and make expensive claims for personal injuries.”

“Rising life expectancy is leading to an increase in the number of older drivers who naturally want competitively priced insurance and the motor insurance market is meeting this demand. But the price of insurance is based on risk, including the higher average claims costs as drivers get older. In addition to a driver’s age, insurers will consider many factors when setting the price of car insurance including claims history, the vehicle, postcode and driving record.

“The motor insurance industry is competitive so it is important to remember to shop around when renewing a policy and consider using a specialist broker or insurer.”

ABI’s top tips for older drivers:

-

Remember the car insurance market is highly competitive so shop around to find a motor insurance policy that best meets your needs.

-

Consider using a specialist broker or insurer to find a more affordable policy.

-

See if a telematics or ‘black box’ device could help you save money on your premium.

|