Between the mid 1990s and the mid 2010s, the number of taxpayers over the age of 65 nearly doubled from 3.32 million in 1995-96 to 6.49 million in 2015-16, the last year for which detailed figures are available; it is estimated that the number has broadly stabilised since then, and stands at around 6.37 million in 2018/19;

Royal London has used the Freedom of Information Act to obtain a detailed breakdown of pensioner taxpayers across the UK ; the data covers every local authority in the UK and provides separate information for men and women; the data relates to the 6.87m taxpayers over state pension age in 2015/16 (the latest year for which detailed figures are available); this includes around 400,000 women over state pension age but under the age of 65; key findings include:

Amongst the 6.87m taxpaying pensioners, the average annual tax bill is £3,522; for the 3.87m men the average bill is £4,341 and for the 3m women the average is £2,467;

More than a quarter of taxpaying pensioners are still in paid work – 1.5m have employment income and 0.5m have income from self-employment;

The total amount of income tax paid by pensioners in 2015/16 was around £24 billion; of this, around £21 billion came from England, £1.7 bn from Scotland, £0.8 billion from Wales and £0.4 billion from Northern Ireland;

The five local authorities with the highest *total* tax bill by pensioners were Surrey (£961m), Hampshire (£763m), Essex (£756m), Greater Manchester (£646m) and Kent (£645m). This means that pensioners in Surrey are paying more in income tax than pensioners across the whole of Wales.

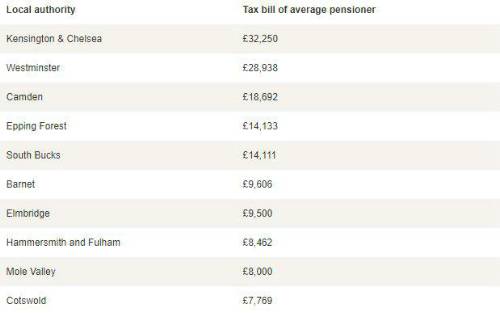

The ‘top 10’ local authorities for average pensioner income tax bills were:

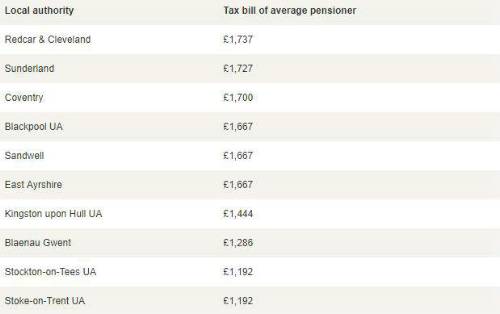

The ‘bottom 10’ local authorities for average tax bills were:

Commenting on these findings, Steve Webb, Director of Policy at Royal London said: “Many people might assume that once you retire you cease to be of interest to the taxman. But these figures show that this is very far from being the truth. The number of taxpaying pensioners has nearly doubled in the last two decades. With talk of also requiring pensioners to pay National Insurance on any earnings or even pensions, the older population may start thinking of themselves as ‘Generation still taxed’. When planning for retirement it is vital to remember that the tax office will still want a slice of your income, which reinforces the need to put aside enough to secure a decent standard of living, even after the tax man has had his slice”.

|