Third of insurers would not insure a driver with phone offence

Phone offences can lead to dangerous driving penalty

Car insurance companies welcome the increase in the penalty for being caught using hand-held phone or other devices while driving.

Insurers have long recognised the seriousness of a CU80 mobile phone offence although until now, the offence has carried the same penalty as an SP30 speeding offence.

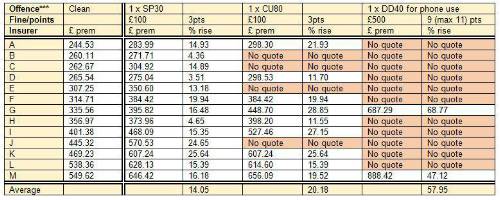

While the average premium increase imposed by an insurance company for speeding is 14%, for a mobile phone offence it is nearly 20% and as much as 29%. Four companies in a survey of 13 insurers refused to offer cover at all, suggesting that around a third of insurance companies would choose to withdraw cover for offenders.

Michael Lloyd, the AA’s director of insurance, says: “Mobile phone misuse – texting, changing music, making calls – is widespread but it requires the offender to be witnessed by an officer while speeding offences can be identified by roadside cameras. A recent clamp-down on phone-drive offences by police caught 8,000 drivers in a week-long campaign – 40 drivers per hour being caught for illegally using a hand-held device while behind the wheel.

“This comes with the launch of a new campaign by the AA Trust and the Department for Transport, highlighting the danger of mobile phone use while driving and launched to mark the increase of the mobile phone penalty on 1 March:

The campaign includes a sticker marked ‘PHONE COMPARTMENT’ to apply to the car’s glove compartment.

“If an officer witnesses a clear lack of attention or dangerous behaviour while using a phone, the offence is likely to be increased to careless or dangerous driving. Only two of the insurers researched would offer cover for someone with a dangerous driving offence to their name, typically increasing their premium by 58%.

“So, if you were caught using your hand held device and inadvertently ran a red light with a resultant near miss, a dangerous driving offence would almost certainly be the result.”

New research for the AA shows that drivers consider texting while driving (71%) to be more than twice as risky as drink-driving (29%).

Adds Lloyd: "A phone call or text message will distract any driver. It reduces the ability to concentrate on the road ahead and puts them and other road users at risk and significantly increase reaction times to road hazards in much the same way as drink-driving. People using a hand-held phone are more likely to crash with the significant risk of seriously injuring or killing someone.

“The only really safe hand-held mobile phone is one that’s switched off and shut in the glove compartment.”

The following table*** shows a range of insurers on the AA’s panel and their attitude towards different motoring offences.

The premium is based on a 35-year-old driver of a Ford Mondeo in Gloucestershire. The results are mixed but the trend is clear – that a mobile phone offence is considered to be more serious than speeding. The research was carried out before the penalty increase for the CU80 offence.

|