A new version of the Continuous Mortality Investigation (CMI)’s projection model, released yesterday, takes mortality data up to and including 2016 as its starting point. Compared with the 2015 version, CMI_2016 reduces life expectancy for a 65 year-old man by 1.3% or nearly four months, and that of a 65 year-old woman by 2% or nearly six months.

Stephen Caine, a senior consultant at Willis Towers Watson, said: “Until recently, mortality rates in the UK were falling at an impressive pace. Since 2011, these improvements have stalled. As the CMI notes, mortality rates in 2016 were about 11% higher than they would have been if the 2000-2011 trend had continued.

“An unprecedented uptick in the number of people dying in the UK each year has led to the CMI’s latest model revising down the projection of how long we will live. For some schemes about to embark on new funding negotiations, adopting CMI_2016 could cut life expectancy for a male retiring now by around six months compared with the assumptions made when they last went through this process three years ago. This could represent a reduction in liabilities of up to 2%.”

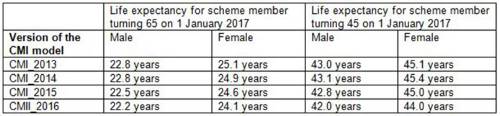

The table shows how successive updates to the CMI model have reduced life expectancy.

Source: CMI Working Paper 97, tables 5.1 and 5.2. Life expectancies are calculated using a standard pension scheme base table (SAPS S1 for 2013 and SAPS S2 for 2014, 2015 and 2016), with mortality rates projected forward using the relevant CMI model. In each case, the CMI model has been calibrated to include a 1.5% long-term rate of annual improvement in mortality rates (the most common assumption recorded by the Pensions Regulator)

Stephen Caine added: “It appears that mortality rates improved modestly in 2016, but only after worsening significantly in 2015, leaving mortality rates roughly where they were in 2011. Another year of heavy mortality strengthens the case that the stall in improvements is not just a blip but could be due to longer term factors. This makes it harder for those in charge of pension schemes to judge the correct assumption for future changes in life expectancy. At a time when many pension schemes are looking to reduce volatility within their portfolios, future developments in life expectancy are perhaps more uncertain than at any point in the last two decades.

“Aside from the impact on pension scheme valuations, another consequence of recent experience is that, unless the Office for National Statistics changes its methodology, the next set of ONS life expectancy projections will follow suit.

This would generate lower life expectancies than the ones being used by the Government in its current review of the State Pension Age.”

There have also been technical changes to the CMI model. Stephen Caine said: “The new version of the model is more pessimistic about mortality improvements at very old ages. Previous iterations assumed that the long-term rate of improvement would become zero at age 120 and would start tapering down towards this from age 90. To better fit the observed data, the new model assumes that improvements start to become slower at age 85 and stop at 110. This reduces life expectancy. Offsetting this, the new model is less sensitive to recent, bad, data. Typically, the net effect of modelling changes is to reduce life expectancy a little, but this varies with members’ ages.”

|