According to PwC’s Pension Funding Index, volatility in markets, including equity market surges and a slight increase in government bond yields, combined to reduce the deficit to £190bn at the end of November, to its lowest level since the UK’s first lockdown.

The Pension Funding Index shows how the UK’s 5,300 DB pension schemes are measuring their own deficits, based on their scheme-specific strategies. For the first time this month, PwC has introduced an Adjusted Funding Index which incorporates two strategic changes available for most pension funds backed by viable companies: a shift towards higher-return cashflow-generating assets instead of gilts, and a deferred approach for funding very long-term potential life expectancy improvements which have not yet happened. Using this Adjusted Funding Index eliminates the aggregate deficit, illustrating the opportunity for pension schemes to consider new approaches.

Raj Mody, global head of pensions at PwC, said: “Most pension fund trustees and sponsors have become conditioned to a world where there is always a funding deficit. The Adjusted Funding Index illustrates that it doesn't have to be that way. You would hope that after years of paying in cash to pension schemes to repair deficits, then eventually that plan would have worked out.

“Trustees and sponsors should review their strategy and deficit assessment afresh, without being tied to historic approaches or assumptions which may now be out of date.”

PwC notes that at the start of this century, funding DB pension schemes was still primarily about building up assets for future use when pensions became payable. Now, DB schemes are typically closed to new entrants and have a more mature profile, paying out around £50bn of pensions annually. That means strategies should adapt to reflect the practical realities of what DB schemes are now required to do.

While this approach may not be appropriate for distressed schemes, those with viable sponsors who intend to run off their schemes over time, instead of transferring them to insurers or consolidators, can focus on generating cashflows for paying pensions as they fall due. In particular, this can include a diversified portfolio of assets whose income matches the pension obligations, including investments such as UK infrastructure. Many pension schemes already operate like this to some extent and there are opportunities to optimise the approach and extend it across the industry. Crucially, this part of the asset portfolio does not need to rely so heavily on UK government gilts and comparable bonds, as is currently the case and as many pension funds are assuming to move into when it comes to calculating their deficits.

Emma Morton, pensions actuary at PwC, added: “The £190bn deficit represents money that companies are planning to pay into their DB pension schemes over the next decade or so. In a lot of cases this money won’t be needed - or, at least, it isn’t needed yet. In the current economic environment, trustees and sponsors could be asking themselves whether there are more efficient ways of running pension schemes. This would allow spare company cash to be directed elsewhere, such as topping up pension accounts for defined contribution (DC) members who typically have lower pension values than defined benefit members."

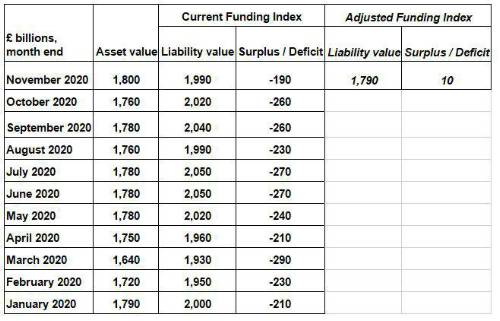

The PwC Pension Funding Index figures this year, and the new Adjusted Funding Index, are as follows:

PwC observes that, across the universe of DB schemes, there have been several cases where scheme deficits have been removed, but then the target has been reset even higher, forcing the sponsor to continue with additional cash contributions. Sometimes there are good reasons for this, for example if the sponsor is not viable in the long term or if the intention is to buy-out the benefits with an insurance company. But in other cases, this approach does not make sense. It could lead trustees to make the wrong decisions about the risk in their investment portfolio, and could cause unnecessary anxiety for members into thinking that the pension scheme does not have sufficient reserves.

|