The research highlights:

• Two in five (40%) consumers accessing their pension for cash for the first time were still working

• Nearly one in four (24%) continue to pay into a pension having flexibly accessed at least one pension while leaving the rest invested.

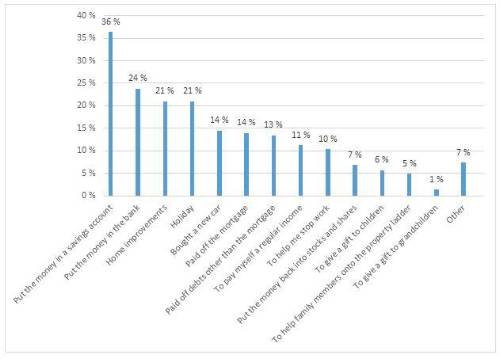

• 60% of cash withdrawals have subsequently been invested in bank/savings accounts

• Holidays (21%), home improvements (21%) and new cars (14%) also popular uses for the cash

• One in five (21%) say they will ‘pension double dip’ with just 5% saying they will withdraw a larger amount the next time around

• ‘No regrets’ as only 10% of those surveyed regret their decision

• 92% of consumers said they knew they would be taxed on withdrawals above the tax free threshold, and 87% said they knew what that tax payment would be

• 68% of people accessing their pension are not currently using a financial adviser to help with their financial planning for retirement

• Two-thirds (66%) didn’t shop around before buying a pension product (either annuity or drawdown) from their pension provider

Andrew Tully, Technical Director at Canada Life, said: “There is no doubt the pension freedoms have been hugely popular, and in the main, it appears people are informed and making sensible choices.

“But some behaviours appear embedded and some poor decisions are being made. These behaviours are likely to continue without the right interventions.

“There are clear tax implications from withdrawing money from a pension, and yet even with a very high level of awareness which indicates risk warnings are working, it doesn’t appear to have sated the appetite to grab the cash and put it into low or no interest bank accounts. This could lead to poor tax efficiency, as well as having a detrimental impact on estate planning unless the funds are required in the short term.

“The lack of shopping around continues unchecked. A significant majority are simply taking the easy route and sticking with what or who they know when looking at an annuity or a drawdown product. This could simply be driven by easy and swift access to tax-free cash, the obvious lack of engagement with a financial adviser or simply overconfidence and lack of awareness of the options available.

“We know people are increasingly accessing their pensions before planned retirement ages, and there are implications for the one in four people who say they are continuing to pay into a pension. The strict HMRC annual limit of £4,000 called the Money Purchase Annual Allowance could be the sting in the tail that catches the unwary out further down the line.

“Interestingly, only 1 in 10 people suggested they had any regrets about their pension. However, one in three people also admitted they had withdrawn cash out of necessity. Could we be storing up trouble for the future? I guess only time will tell.”

So what have people used their cash lump sums for?

Source: Canada Life 20.3.19 (note respondents could tick all that apply)

The Money Purchase Annual Allowance explained

The MPAA was introduced in April 2015 to prevent people using the pension freedoms to recycle money through a pension and effectively receive additional tax relief on those savings. The MPAA restricts the amount available to save into a pension once it has been ‘flexibly accessed’, with the limit triggered for example by taking a taxable income from drawdown. In practice this means anyone who has withdrawn either a cash lump sum or income in excess of their 25% tax-free lump sum from defined contribution type pensions.

The restrictions include any payments into a pension, both made personally or via an employer. The MPAA was reduced from £10,000 to £4,000 in April 2017. The charge on excess contributions above this limit effectively cancels out the tax relief.

As an example, someone who is taking an income from their drawdown portfolio but still working, earning £50,000 a year, and together with their employer paying more than 8% into their pension would face a MPAA tax bill.

There are various (and free) online resources available to help people considering their options make better informed decisions before withdrawing money from their pensions, including here https://www.canadalife.co.uk/tools/pension-tax-calculator

Media case studies are available upon request.

|