Historically, when considering fiduciary managers, trustees and other stakeholders have struggled to compare track records, meaning decisions were often made on anecdotal evidence. The GIPS standards, approved by the Competition and Markets Authority (CMA) in December 2019, helps trustees select and monitor fiduciary managers by enabling performance comparison.

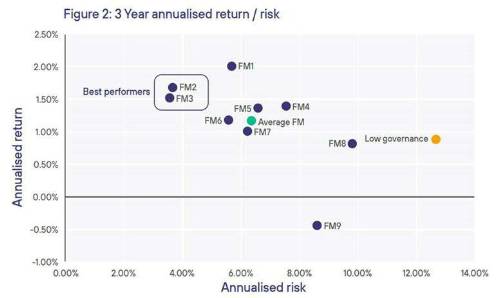

Isio analysed three years’ of GIPS data from 12 FMs, which together manage over 90% of UK fiduciary management assets under management. In its ‘A beginner’s guide to assessing fiduciary manager performance’ report, the investment advisory specialist not only compares the fiduciary managers amongst themselves, but also against a low governance option that follows a simple investment strategy, allowing Trustees to assess whether they are receiving value for money from their provider.

A capable fiduciary manager should be able to achieve strong risk adjusted returns over the long-term and consistently perform better than a low governance option. When analysing the data, Isio found that the fiduciary managers in this study all underperformed return objectives but (most) outperformed the low governance option.

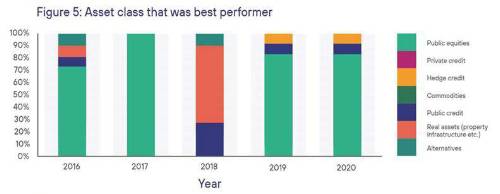

The research also found that equities have by far been the single biggest driver of returns over the last five years, although due to the market sell off during Q4 2018, real assets stood out as the best performing asset class during that year demonstrating the importance of diversifiers within portfolios.

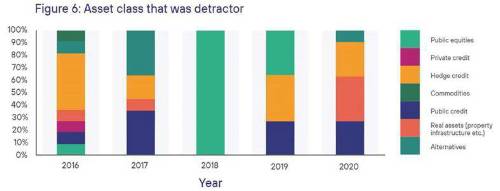

Conversely, hedge funds have been common detractors for fiduciary managers across the five years followed by public credit (e.g. investment grade credit, high yield, emerging market debt, etc.) and alternatives.

Looking to the future, the risk of rising interest rates and further uncertainty in relation to the pandemic and vaccine roll-out have been identified as the biggest challenges for 2021. Nearly 60% of the managers surveyed believed that equities will be a key area of positive performance across the short, medium and long term and fiduciary managers are also expecting a renewed focus on sustainable / responsible investing as economies emerge from the pandemic.

Paula Champion, partner and Head of Fiduciary Management at Isio commented: “The intervention of the CMA has really changed the fiduciary management landscape, providing a long-awaited injection of competition into the market. Those put in charge of managing billions of assets need to be accountable for their actions.

“The presence of GIPS data is a fundamental improvement in performance transparency and comparability, but the process of being able to take the data and use it effectively is still in its infancy. Our report aims to guide trustees and pension scheme stakeholders through the key questions they should be asking.

“Finding answers to these questions and considering this type of analysis will not only help them to select the best fiduciary manager for their needs, but ensure they continue to perform well and add value on an ongoing basis.”

|