Freezing of the pension lifetime allowance at £1,073,100

“Announced at the recent Budget, this change is significant and will affect more people than you might think. A million pounds sounds like a huge sum but the reality is that for someone aged 65, it will buy an income of around £26,100 a year increasing in line with inflation* before tax. After basic rate tax, this equates to a monthly income of £1,950**. Most people would agree that’s hardly going to provide a life of luxury and by freezing the amount that can be saved in a pension without incurring a tax charge, the Chancellor has effectively introduced a stealth tax.

“Many of those affected have simply being doing the right thing and saved regularly over many years or have benefited from good investment growth in their defined contribution pension. The other main group affected by this are public sector workers with many doctors and senior officials likely to be caught out by the change. The lifetime allowance?in these?schemes is an annual pension amount of one twentieth of the ‘cash’ limit, or £53,655 a year.

“If you’re concerned this change may affect you, we recommend you speak to an adviser.”

New living wage will draw more people into auto-enrolment

“The increase in the Living Wage from £8.72 to £8.91 will mean all those working more than 22 hours a week will meet the £10,000 minimum earnings threshold that qualifies them for a workplace pension. It’s a modest increase in terms of wages but for those who now qualify for auto-enrolment, it will mean they start building up a pension pot for their retirement. They will need to make a personal contribution but in return will benefit from a valuable 3% employer pension contribution too.”

State pension uprating worth around £230 a year

“The state pension is increased each year, currently according to the triple lock which means pensioners receive an increase of the highest of earnings growth, inflation or 2.5%. From April the New State Pension increases from £175.20 per week to £179.60 and the Basic State Pension from £134.25 to £137.60. These increases will be worth around £230 and £175 a year respectively to those who receive them.

“There is some debate about the future of the triple lock given the government’s focus as we recover from the pandemic on balancing the books. The possibility of a strong rebound in earnings as the economy recovers from the pandemic and also higher inflation mean that pensioners could be in line to receive a bumper increase next year. If either of these factors do materialise, there is likely to be pressure on the Chancellor to smooth the increase at the very least. Remember, there’s no ‘fund’ from which state pensions are paid out – the costs are met from National Insurance contributions from today’s workers.”

Pandemic savers benefit from fresh ISA and pension allowances

“We’re a nation of two halves when it comes to saving right now. Our research has found that many of those who’ve kept their jobs and seen their opportunities to spend reduced, have started saving a lot more. Figures show the extra household savings accumulated in the first three quarters of 2020 amassed to £148bn. Not everyone is in the same position and many are struggling financially.

“However, for those lucky enough to be putting more aside, the ISA allowance will refresh on April 6th allowing people to save up to £20,000 a year in a tax efficient way. The pension annual allowance is reset at £40,000 (or 100% of earnings, if less).”

LISA exit penalty returns

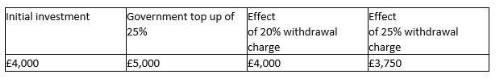

“To support younger people hit by the pandemic having to dip into savings, the Chancellor reduced the exit penalty on the Lifetime ISA from 25% to 20%, but from 6 April, it returns to its previous level.

“Younger savers may argue we’re not yet out of the pandemic and that many still have pressures on their finances but longer-term the government was always likely to reintroduce the full penalty. By increasing the penalty to its previous level it now costs savers more to make an ad hoc withdrawal. If the original penalty had not been reinstated, it would have affected the balance of incentives between the LISA and a standard ISA.”

LISA penalty explained

*Retirement income at 65 is based on how much it currently costs to buy an annuity using the average of the top 3 annuity rates from the Money Advice Service annuity comparison tool on 2 March 2021. Income is paid monthly in advance and assumes the individual is in good health. We assume the income will increase in line with the RPI measure of inflation.

** Based on basic rate tax of 20%, taking account of £12,570 personal allowance, leaving a taxable income of £10,824.

|