Recent press speculation suggests that the government has put the second phase of the pension review on hold. Despite this, concerns are rising around DC pension adequacy and expectations that fewer members will meet their retirement income goals, DC:UK Savings Watch aims to provide valuable insights for both employers and trustees.

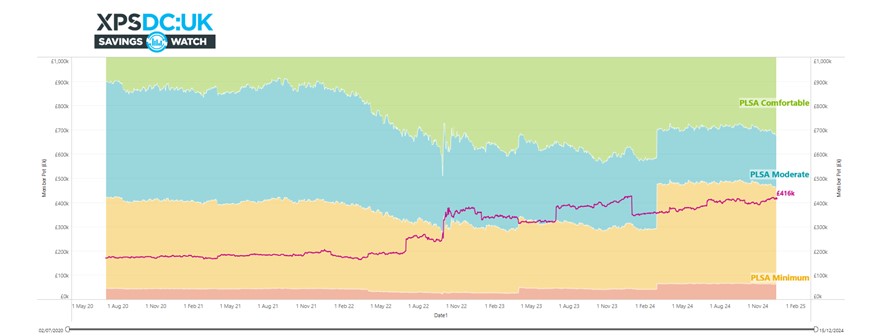

XPS Group has launched a new tracker, ‘DC:UK Savings Watch’, anticipating the value of a typical DC pension pot at retirement (shown in today’s terms). This is mapped against the estimated amount required to achieve the Pension and Lifetime Savings Association (PLSA)/Loughborough University Retirement Living Standard’s minimum, moderate and comfortable lifestyles in retirement.

XPS DC:UK Savings Watch, updated daily, provides insight on a typical member and how their projected DC pension pot changes over time, based on a variety of factors including market dynamics and inflation expectations.

Regularly recalibrated against data from the PLSA/Loughborough University Retirement Living Standards, UK Government, MoneyHelper and market data from the London Stock Exchange Group, XPS DC:UK Savings Watch presents the estimated retirement DC pension pot in today’s terms, showing how close a member might be to achieving certain retirement standards.

Mark Searle, Head of DC Investment at XPS Group, said: “The second phase of the pension review was a real opportunity to put in place long term plans to improve retirement prospects for generations to come. Recent press speculation has indicated that this has been put on hold. It’s disappointing that the government are no longer prioritising the adequacy problem, so the solution necessarily lies with trustees, employers and individuals themselves. XPS DC:UK Savings Watch not only models a typical DC pension pot, it can also model scheme specific data to help employers and trustees understand the savings targets their members need for a secure retirement. By aligning projected pension pot values with recognised industry living standards, we aim to empower employers and trustees to support their members and provide clearer insights on retirement adequacy.

We know the importance of planning for a future that aligns with financial goals, so we’re excited to launch XPS DC:UK Savings Watch as a practical way to help employers and trustees identify the gap between retirement aspirations and realities. Early intervention through changes to the investment strategy and / or contribution levels can then be discussed to move members to a more secure retirement.”

|