By Stuart McDonald, Partner, Head of Longevity and Demographic Insights

The Office for National Statistics (ONS) have released details of a new methodology for estimating excess mortality for the UK and its constituent countries. The new approach will be adopted by ONS, National Records of Scotland (NRS) and Northern Ireland Statistics and Research Agency (NISRA) for reporting from this week onwards.

I was delighted to be asked to participate in the development and launch of the new methodology, and it has been valuable to work closely with ONS and other government statisticians, and another independent expert from the Continuous Mortality Investigation (CMI).

Key points that are relevant to trustees and sponsors of defined benefit (DB) pension schemes are:

The new approach improves consistency of UK-wide excess deaths reporting, reducing any confusion arising from different measures. It brings the methods and results produced by national statisticians more in line with robust methods already used by the actuarial profession and in LCP analysis.

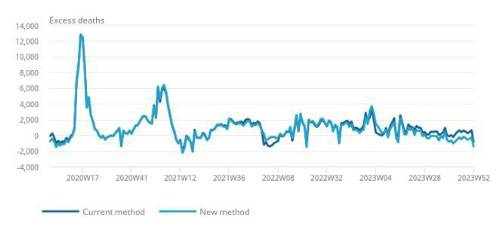

The new method highlights the normalisation of mortality rates over the second half of 2023, with overall death rates staying lower than expected for the longest sustained period since the pandemic. However, it does not significantly change public understanding of the pandemic’s immediate impact, with excess deaths in 2020 and 2021 little changed.

The new method allows improved analysis of past mortality but does not answer questions about what has driven mortality trends in the past or what the future will bring. LCP is able to provide this insight by combining actuarial methods with expert input from epidemiologists, medical doctors and other health experts.

Chart – Current and new methods produce similar estimates of excess deaths during the peak of the pandemic but the new method shows no excess in the second half of 2023

In developing the new methodology the technical working group sought to satisfy the following principles:

Modelling which is transparent and whose principles can be understood by users

A method that can be used and adapted in the future, not just a way of measuring the impact of the pandemic

Unbiased over the long term, so excess deaths in normal times should be equally likely to be positive or negative

Makes allowance for ageing and growth of the population – the model should not indicate excess deaths just because there are more older people

Allows for mortality trends over time, comparing deaths to what we expected this year, not an average centred on a few years in the past

Allows for seasonality which is a significant feature in UK mortality data (there are more deaths in the winter)

Suitable for different countries and regions as well as the UK overall

Produces confidence intervals, helping users to understand that excess deaths are always an estimate

Accurate analysis of mortality is important to trustees and sponsors of defined benefit (DB) pension schemes to determine liability estimates, set member option factors, refine journey planning, implement more efficient investment strategies and to better assess the value-for-money of insurance transactions.

LCP mortality advice combines analysis of the socio-economic profile of scheme membership with insights into what is driving excess deaths and how long this may persist into the future. This enables us to refine assumptions to reflect the membership of your scheme. Understanding how the pandemic and ongoing health system challenges are impacting your members puts you in the best position to adopt an assumption that is right for you.

But analysis like this has wider repercussions, as it informs population health management initiatives and our understanding of how health and life expectancy is changing across society. We were delighted to provide pro bono support to government on this important initiative.

|