The leading data and analytics company found that as concerns regarding the NHS rise as a result of this increasing pressure, private medical insurance may see an increase in policy holders.

Ben Carey-Evans, Senior Insurance Analyst at GlobalData, comments: “Issues with the NHS this winter has been a constant topic in UK news. Therefore, the vast majority of consumers would have heard about it and will be wary about potential waiting times for GP appointments, treatments, or even emergency services. This is likely to make many people nervous, especially as concerns around health have been heightened since the pandemic. This will almost certainly lead to an increasing interest in private medical policies.”

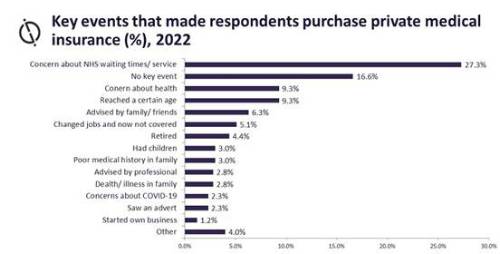

GlobalData’s 2022 UK Insurance Consumer Survey found that ‘concern about NHS waiting times/service’ was the leading trigger for purchasing a private medical insurance policy that year, as cited by 27.3% of respondents. It had a substantial lead over the next most influential factors, which were ‘concern about my health’ and ‘reached a certain age’ (both 9.3%).

This survey highlights how much the proportion of respondents selecting ‘concern over the NHS’ as their leading trigger has increased compared to the same survey conducted in previous years (2020’s figure was 20.4% and 2021’s was 24.8%). This indicates that pressure from COVID-19 has had a significant impact on both the NHS and consumers’ concerns regarding the service.

Carey-Evans concludes: “Any expected growth in private medical insurance may be offset by the cost-of-living crisis. Record inflation and energy prices in particular have led to a vast decrease in disposable income, prompting consumers to look at where they can save money. As a result, taking on new expenses will be a struggle for many at this time. However, the NHS backlog is showing no sign of shortening, so consumers will increasingly be looking towards the insurance industry to help them receive healthcare.”

|