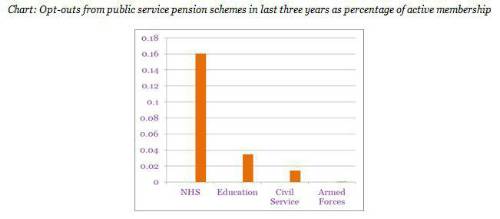

As summarised in the chart below the opt-out figures are 3.4% for the Teachers’ scheme, 1.45% for the Civil Service Scheme and 0.04% for the Armed Forces Scheme.

New calculations by Royal London show the large amount of pension rights that are being given up by individual NHS workers who opt out. An NHS worker earning £25,000 per year (pay band 3) currently has to pay a contribution of 7.1% before tax relief. After tax relief, opting out would save them £1,420 per year. But replacing that pension in retirement would cost a lump sum of around £13,000. Workers who opt out are giving up pensions worth around nine times what they save.

Although some of the opt outs in the NHS scheme are due to senior consultants and GPs leaving because they have reached tax relief limits for high earners, the evidence is that NHS workers aged 26-35 were the most common age group to opt out, with 30,000 workers in this age band choosing to do so in 2017 alone.

Across the public sector, employees have faced a number of squeezes on their take-home pay in recent years which may have contributed to high levels of opt out. These include:

- A series of public sector pay freezes or below-inflation increases;

- The ending of ‘contracting out’ in 2016 which led to an increase in employee National Insurance Contributions;

- Increased contribution rates into public service pension schemes;

In addition, whereas automatic enrolment into private sector ‘defined contribution’ pension schemes has been phased in very gradually, public sector workers in ‘defined benefit’ schemes were enrolled at the full contribution rate over night. This will have been much more of a shock to their take-home pay than the phased introduction of automatic enrolment in the private sector. But it is not yet clear why the impact of these various factors has been so much more acute in the NHS than in other similar pension schemes.

Steve Webb, director of policy at Royal London, said: “The NHS as an employer needs to take urgent action to tackle this epidemic of pension opt-outs. All public sector workers have faced a squeeze on their take-home pay in recent years, but it is in the NHS where this has translated into shockingly high numbers of people leaving the pension scheme. Those who opt out will save money in the short term, but could lose nine times as much in the long-term in reduced pension rights. The NHS needs to find better ways to communicate the value of NHS pensions, otherwise large numbers of NHS staff risk a retirement in poverty”.

|