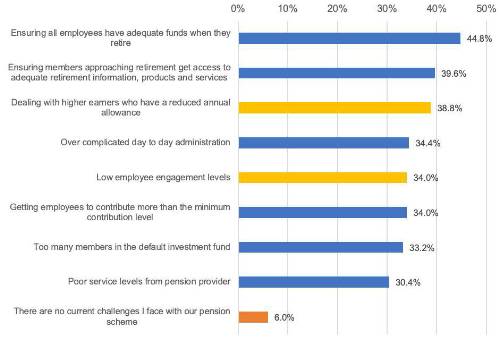

Recent pensions research from Smarterly shows that 94% of employers face challenges when providing their employees with a workplace pension. Whilst the biggest reason for this appears to be ensuring that employees have adequate funds when they retire, with 45% citing this as a key issue, other key problems include poor service levels (30%) from pensions providers and low engagement levels from employees (34%).

Other key reasons for the challenges facing employees include ensuring that those approaching retirement have access to adequate information (40%), dealing with higher earners with a reduced annual allowance (39%), overcomplicated administration (34%) and getting employees to contribute more than the minimum contribution level (34%).

Smarterly’s research also shows that two-thirds (65%) of employers believe that current pension providers are not doing enough to offer new, progressive products and 63% would like to see a new disrupter or challenger move into the pension provider space. While the annual management charge is still the number one concern for employers when it comes to choosing a scheme, employers are still looking for good communication services (37%) and online services (35%).

Given these widespread difficulties, it’s perhaps not surprising to find that a vast number of employers are looking to review their current pension provider in the very near future – more than half (54%) of respondents are planning to carry out a review in the next six months, while almost nine in ten (87%) expect to review their provider within the next year.

Steve Watson, head of proposition of Smarterly, said: “Pensions continue to present a myriad of problems for employers but the majority all link to low employee engagement levels especially amongst millennials. Our research shows that fewer than one in ten millennials are worried about their retirement savings and 40% of employers are considering offering a workplace savings vehicle such as an ISA alongside a pension scheme to support employees more immediate needs, such as getting a foot on the housing ladder. A far more engaging proposition.”

|