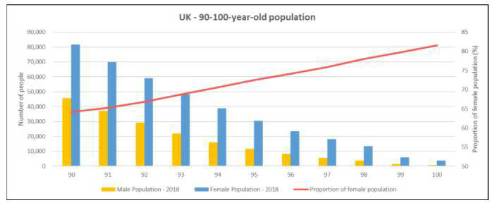

Statistics from the government Office for National Statistics (ONS) reveal that of the 57,000 90-year-old women recorded in 2008, around 3,930 received a letter from the Queen in 2018. Equivalent to 6.9% of those alive at 90 reaching the milestone age of 100.

In contrast, 890 men turned 100 last calendar year – just 3.7% of the 24,000 90-year-olds recorded in 2008, roughly half the proportion of women.

As a consequence, there is an 18-percentage point increase in the proportion of women in the population aged 90 (64%) and 100 (82%).

Just Group’s communications director, Stephen Lowe, said that life expectancy remains the cornerstone of later-life financial planning, commenting: “Longevity in the UK is still nudging higher so it is crucial that people and their financial advisers bear this in mind when establishing their later-life financial plans.

“For example, couples should think beyond the ‘honeymoon period’ of early retirement and have plans in place to manage the probability that one may outlive the other by a significant period of time. Death and finances are not easy topics of conversation but avoiding them could cause greater upset and difficulty further down the line.”

“On average, women will enter retirement with less savings and so, whether they are in a couple or single, they should think through their options given they are much likelier to live longer than men.”

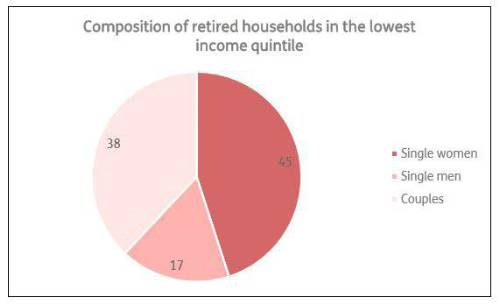

There are other factors to consider: women represent a far higher proportion of the elderly single and widowed population; and single women are far more likely to be on a lower income than single men.

From age 70 upwards, there are about one million more widowed women than men and of every 10 people aged 70+ who are not living as part of a couple, seven are women. Of retirees in the lowest income groups, 45% are single women, 38% couples and 17% single men.

The Equity Release Council’s latest report predicted further growth in business from single pensioners, and single women are taking more than double the number of new equity release plans as men in H1 2019.

“Given the gap in pension provision between men and women”, said Stephen Lowe, “we foresee more growth in equity release as women seek to supplement their incomes in later life, enabling them to stay in their homes and communities.

“It reinforces the point that everybody heading into retirement – couples as well as singles – needs to think about the ‘what ifs’ of later life and make plans to keep sufficient income flowing for as long as it is likely to be needed.

“Our view is that equity release works best when people have considered their housing wealth as part of their wider pension and retirement planning."

|