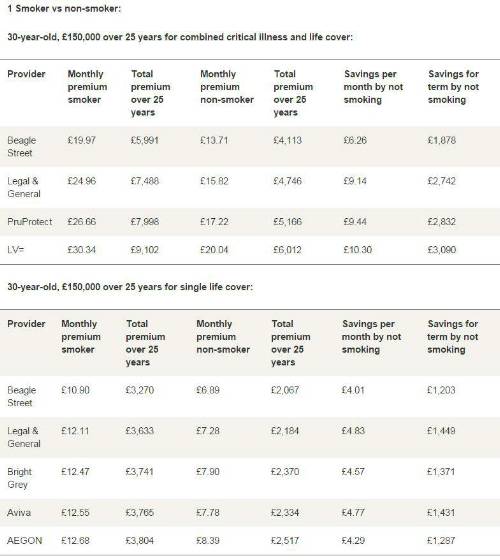

MoneySuperMarket’s analysis reveals smokers stubbing out cigarettes for good can make huge savings on combined life and critical illness cover and single life cover1. For example, a 30 year old non-smoker would typically save around £3,090 on the cost of a £150,000 combined policy over a 25 year term – or a saving of £10.30 a month compared to the cost of the same policy for someone who smokes.

The research also found considerable savings for those taking out single life cover; £1,449 saved over a 25 year term for a 30 year old non-smoker wanting a £150,000 policy compared to that quoted for someone who smokes.

Kevin Pratt, insurance expert at MoneySuperMarket, said:

“Most importantly, kicking cigarettes can have a life-saving impact on your health, but another huge benefit for quitters are the savings they can make on the cost of their life insurance if they stay smoke-free.

“Insurers classify a ‘non-smoker’ as someone who hasn’t smoked for a full year, this includes tobacco-replacement products they might be on, such as nicotine patches and you'll probably still have to pay smoker's rates if you switch to e-cigarettes. Insurers use medical examinations to prove a claimant is a non-smoker and the substance tested for still exists when people are using a nicotine inhaler or smoking an e-cigarette. If nicotine replacement users were offered reduced premiums (in the same way as non-smokers), then a tobacco smoker might claim just to be a nicotine patch user, not a tobacco user. So insurers refuse to offer lower premiums to anyone who tests positive when tested.

“Those hoping to stub out the habit this No Smoking Day should use the potential life insurance savings as another motivation to quit and, in the meantime, shop around for a deal best suited to their needs before they qualify for ‘smoke-free-prices’.

“Giving up smoking for good isn’t an easy venture – it can become a part of your everyday routine. But the positive impacts of quitting are far-reaching for health and for wealth. We’re encouraging people to think about the money they could save by joining the other smokers choosing to quit on March 11 – according to The British Heart Foundation someone smoking 20 a day could save over £3,000 a yearif they stopped; enough for a holiday or a new kitchen instead of watching your hard-earned cash go up in smoke.”2

2 The British Heart Foundation says that someone smoking 20-a-day would save £3,102.50 a year, based on a 20-a-day smoker paying £8.50 per packet of 20 cigarettes:

|