Under current auto-enrolment (AE) rules, 2% of an employee’s salary is put into their pension, typically 1% from the employee and 1% from the employer.In April 2018 that total will rise to 5% (3% employee, 2% employer) and in April 2019 it will increase again to 8% (5% employee, 3% employer).

There are fears that the increases could lead to more people opting out of saving into their pension. But Aviva’s figures suggest that isn’t the case with just 4% of people planning to leave their pension scheme when contribution levels rise.

Will they stay or will they go?

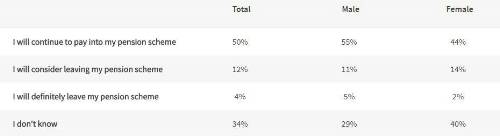

There is further good news as 50% of people surveyed by Aviva say they will definitely stay opted in.This leaves a third of employees (34%) unclear on what they will do and 1 in 8 (12%) say they will at least consider leaving their pension scheme. In the next few months it will be crucial to keep this group of people informed about the changes and the benefits of continuing to save into a pension.

However, there is evidence that people do change their minds when it comes to pension saving. The 2012 ‘Attitudes to Pensions’ survey by the Department for Work and Pensions** asked people what they were likely to do once they had been auto-enrolled. 70% said they would definitely or probably stay in, 15% said they would definitely or probably opt out and 14% said it would depend. Five years on and the opt out rate is only around 10%, much lower than those figures predicted.

Gender divide

The research has also revealed a gender divide when it comes to pensions. 5% of men say they will definitely opt out when contributions increase, compared to 2% of women.The research also found that 44% of women said they will definitely stay opted in compared to 55% of men. Women also appear more uncertain of the choice they may make with 40% saying they do not know what they will do when contributions rise, compared to 29% of men.

In 2018 auto-enrolment contributions for employees will rise from 1% to 3%. In 2019 they will rise to 5% of salary. When that happens, what are you likely to do?

Employers prepare for contribution increases

While much of the focus of auto-enrolment is on the actions of employees, the role of employers is vital in continuing the success of AE as they have to make contributions on behalf of their staff.

Aviva’s Working Lives Report found that a quarter of businesses (25%)*** are prepared for contribution increases as they won’t have any major impact. 29% said they were already contributing more than the planned increase. Just 20% of firms said it will affect their ability to increase employee wages. In a further positive sign of employers’ commitment to workplace pensions, almost three quarters (73%) agreed they had some kind of responsibility for helping their employees save for an adequate retirement.

Colin Williams, Managing Director, Workplace Benefits at Aviva, said: “There are huge positives that can be taken from our findings. Only a small proportion of people appear to be intent on opting out of their pension when contributions rise. The fact this number is so small is an indication of the impact AE has had on changing the savings culture and helping people onto the path of saving for retirement.

“The fact that businesses seem to be prepared for the increases is another positive sign. They will be key to engaging employees with their pension scheme and communicating the benefits of making higher contributions.

“But this doesn’t mean we should be complacent. Next April contributions are only rising to a total of 5% of salary. This is still well short of the level we believe is necessary to deliver a reasonable retirement for most people. Aviva has already called for minimum contributions to rise to 12.5% by 2028.

“By staying opted in savers will benefit from their employer putting more into their pension and the government putting in more as well through tax relief. The result will be that they are giving their future self a pay rise.”

*SURVEY OF 2,007 PRIVATE SECTOR EMPLOYEES CARRIED OUT FOR BY ICM (Q1 2017) FOR AVIVA’S WORKING LIVES REPORT

**HTTPS://WWW.GOV.UK/GOVERNMENT/UPLOADS/SYSTEM/UPLOADS/ATTACHMENT_DATA/FILE/193372/RREP813.PDF (P64)

***SURVEY OF 500 SMALL, MEDIUM AND LARGE BUSINESSES IN THE UK CARRIED OUT BY ICM (Q1 2017) FOR AVIVA’S WORKING LIVES REPORT

|