According to data from its Drawdown Governance Service (DGS) – a tool used by advisers to assess their clients’ income sustainability - people are taking income at rates varying from 4% to 10% depending on their pot size and income needs. An income withdrawal rate of 4-5% a year has traditionally been considered sustainable. However, the data showed two broad groups of customers using income drawdown in different ways.

The group with smaller pots (below £25,000) tended to take their income at a higher median rate of approximately 10%. Although a withdrawal rate of 10% would be unsustainable for a pot designed to last through retirement, many of those drawing down a pot at this rate are likely to be planning to rely on other income later in retirement. For example, they may be running down one pot to support them in early retirement before their state pension and other retirement income kicks in at a later stage

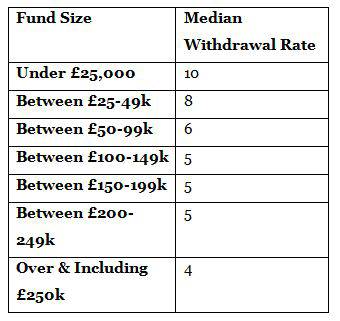

However, the group with larger pots of over £250,000 are taking income at a much lower median rate of 4%. See table below for spectrum of income rates in the sample we looked at.

Commenting on the data, Royal London’s head of investment solutions Lorna Blyth, said: “What the data tells us is that following the introduction of pension freedoms there is no such thing as a typical income drawdown customer. Regardless of pot size people are utilising income drawdown to help them structure a retirement income that meets their needs. Client segmentation is a key focus under PROD rules and this data shows a link to taking income according to a client’s needs rather than wealth. Using our Drawdown Governance Service helps advisers to track whether clients remain on track to meet their retirement income goals and forms a basis for discussion if changes need to be made.”

|