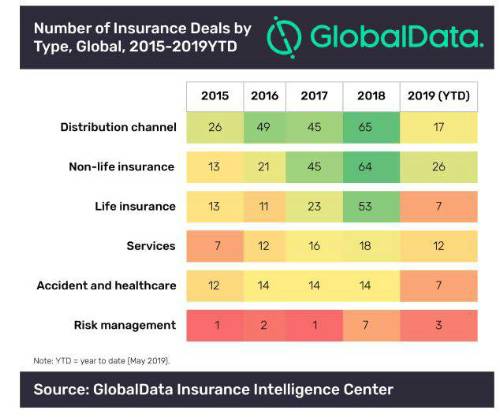

Ben Carey-Evans, Insurance Analyst at GlobalData, comments: “The sector has overtaken last year’s leaders, life insurance and distribution channels, which had achieved seven and 17 respective deals by May 2019. Non-life insurance has also experienced a rise in investment in start-ups, demonstrating strong innovation. Key products in the sector are being revolutionized by challenger insurers offering simple, digital and often on-demand policies to consumers.”

GlobalData’s latest report, ‘Digital Challengers in Insurance - Thematic Research’, shows that the highest number and value of deals occurred in the non-life sector. Motor, home and travel products have all seen a rise in innovation and interest from investors since the start of 2018.

Carey-Evans continued: “The key trends in motor, home and travel insurance are digitalization and simplification, with start-ups that offer instant quotes and easy sign-up processes thriving.”

US-based Root Insurance utilizes telematics and a smartphone app to offer instant and preventative cover. Its policies can be bought in one minute without forms or phone calls, and the customer’s driving behavior is measured through the app. The company received £350m of funding in August 2019. Meanwhile, Hippo received $100m in July 2019 due to it taking a similar approach to home insurance. It capitalizes on two key themes seen in digital household insurance in recent years, automating the signup process to provide almost instant quotes and the inclusion of smart tech in the home. This brings its overall funding to $209m, a clear sign that digital start-ups are becoming increasingly valuable.

Carey-Evans concludes: “These two sizeable investments are part of a trend in the non-life sector. Insurers continue to target millennials, aiming to offer them the same level of service they have become accustomed to from other industries. Aviva launched its AvivaPlus policies for home and motor, which are flexible, can be cancelled at any time and are paid for on a monthly subscription basis.

“Digital challengers are beginning to shape the insurance industry, especially non-life products, as they continue to introduce innovation and improve choice and service for customers.”

Information based on GlobalData’s report: ‘Digital Challengers in Insurance - Thematic Research’.

|