By Chris Daykin, Director NOW: Pensions By Chris Daykin, Director NOW: Pensions

Having been involved in pension reform in the UK and elsewhere for 25 years, I am keen to see the auto-enrolment (AE) project succeed. Other countries have implemented mandatory DC schemes to achieve universal funded pensions, with varying degrees of success. When the Pensions Commission recommended auto-enrolment, following closely on the heels of the adoption of such a system in New Zealand, it seemed to offer hope of giving everyone the chance to have a complementary pension.

Existing DC offerings in the marketplace suffer from many problems, notably high charges, volatility of the pension outcomes and shortcomings in the annuity market. The launch of NEST as a government-backed low cost provider has thrown down a challenge to the private sector, but NEST has limitations imposed by the legislation, notably the cap on earnings and the inability to take in lump sum investments, thus precluding the possibility of collecting together pre-existing pots of DC savings.

The AE solution which NOW Pensions is bringing to the UK market directly addresses the four issues which are of preeminent importance for ensuring a successful member-friendly individual account arrangement:

- low costs

- an effective customer-friendly investment approach

- a solution which makes it easy for employers to implement AE

- member-oriented governance structure

NOW has set the charge for investment management at 0.3% a year of accumulated funds, in line with NEST and well below what is available from most financial sector offerings, although charges approaching this level may be negotiable for a few very large schemes. Administrative charges of £1.50 per person per month are easily understood and are aligned to the costs. Lower fixed charges apply until 2018 for those earning less than £18,000 a year.

The NOW Pensions investment approach recognises the reality that the great majority of members will not have the expertise or the interest to choose between investment funds. Most members opt for the default fund, even when choice is offered. What is needed is an investment approach which provides good real returns while safeguarding the members’ future pensions from undue volatility and risk.

NOW builds the investment strategy around retirement age. The default is state pension age but individuals can choose a different age. For the period up to ten years before the retirement age investment is in a diversified growth fund. Then in the ten years leading up to retirement age there will be a gradual transition so as to produce 25% invested in a cash fund and 75% in a fund which hedges the interest rate element of annuity purchase price risk.

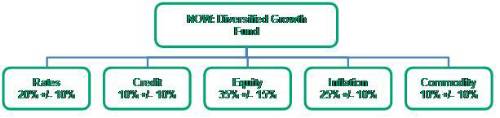

There are many different approaches to diversified growth funds. NOW uses an allocation to five main classes, as shown in the diagram below. Although allocation between classes relies on manager expertise, it is also subject to a very tight process of risk budgeting and active risk management with various triggers to force response to evolving circumstances and protect the fund against adverse movements.

The target levels and ranges for the distribution of risk between the five risk classes are set by the trustees from time to time. Risk is measured as the average size of the worst losses that are expected to materialize with 1 percent probability on a 3 month horizon.

NOW Pensions is not promoting a new and untested approach but is building on 40 years of experience of operating a similar strategy for ATP, the funded part of the Danish social security system. In Denmark the strategy has realised an average real return of 7.2% a year over the last decade, in spite of the global financial crisis and huge volatility in traditional markets, achieving a nominal return on funds under management in 2011 of 26%.

NOW has teamed up with Xafinity Paymaster to offer the administration for the scheme and will provide a comprehensive service to assist employers to implement AE, with whatever contribution structure they request, covering all levels of remuneration in an organisation and offering excellent opportunities for cost-effective consolidation of pots from existing DC arrangements.

The statutory minimum contribution levels at which employees have to be auto-enrolled into the new system are not high enough to generate a satisfactory level of funded individual account pension. In the longer term it will be critical to persuade both employers and employees to contribute regularly at higher levels.

NOW Pensions is a UK-based master trust with trustees who all have a strong track record in pensions or HR. As one of the trustees I look forward to playing a part in making a highly effective solution to AE available to UK employers and ensuring that NOW Pensions continues to put the interests of members to the forefront.

AE has the potential to transform the pension scene in the UK and to reverse the decline in private pensions which we have seen over the last 15 years. However, for it to succeed where previous attempts have failed (remember stakeholder pensions?) there needs to be a change of culture towards providing the products that individuals really need at a price which they can really afford.

|