Failing to shop around when buying an annuity can easily lose pension savers thousands of pounds, but retirees delaying purchase until later in life risk losing the most income.

More than 1,500 annuities were sold every week in 2023/24 but four in 10 (41%) are to retirees buying from their existing pension provider1, raising concerns many may inadvertently be choosing convenience over value.

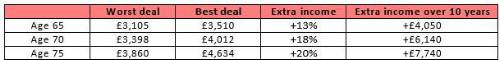

Analysis of current annuity deals by retirement specialist Just Group shows significant gaps between the best and worst income on offer, and that older buyers face a much higher income gap than those buying at younger ages.

A healthy 75-year-old can secure 20% more income from the best annuity provider compared to the worst. The best-worst gap is 18% at age 70 and 13% at age 65. The income offered could be higher once medical history and lifestyle factors are disclosed.

Based on £50,000 purchase price, single-life, level lifetime annuity, 5-year guarantee

Stephen Lowe, group communications director at Just Group, said that improving returns had pushed up demand for annuities but warned buyers must do their homework in order not to get short-changed.

“The gap between the best and worst deals has been rising through this year. That is true for all ages we track but is currently particularly high at 20% for buyers aged 75,” he said.

“Annuities provide secure income, giving people peace of mind to spend what they receive without worrying if it will rise, fall or run dry during their lifetime. But there are no second chances when you buy an annuity – you must get it right first time.

“That means disclosing health and lifestyle information that could push the rate higher, then shopping around to find the most competitive deal. The better the deal, the more lifetime income you get.”

He said all retirees should take the free, independent and impartial guidance from the government- backed Pension Wise service. Professional annuity brokers or financial advisers can help retirees choose options and scour the market for the best deal.

Figures from the Financial Conduct Authority show that in 2023/24, 33,000 (41%) of the total 82,000 annuities purchased were from the retiree’s existing pension provider.

“The annuity market is very competitive and rates will vary across providers. It’s very unlikely your own pension provider will offer the top rate and settling for a lower amount initially will, over time, multiply into significant sums of lost income,” said Stephen Lowe.

|