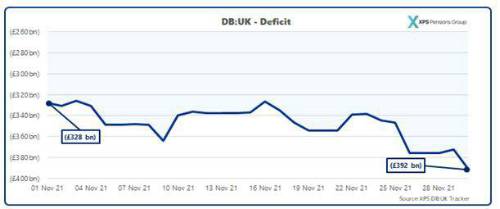

Based on assets of £1,959bn and liabilities of £2,351bn, the average funding level of UK pension schemes on a long-term target basis was 83% as of 30 November 2021.

Drivers of the change

This change was largely driven by rising inflation expectations and a significant fall in gilt yields, while equity markets and oil prices continue to recover from worst day for equity markets this year following the emergence of the new Omicron Covid-19 variant. The markets’ reaction to Omicron alone added £30bn to UK DB deficits overnight.

DB:UK tracks the funding position of UK defined benefit (DB) pension schemes on a long-term target basis and allows real time monitoring of changes and analysis of the reasons behind any movement.

Tom Birkin, Consultant, said: “Rising inflation expectations and falling gilt yields added another £136bn to UK DB liabilities this month, with CPI now being expected to peak at 4.4% or higher during 20221. This period of significant market volatility looks set to continue with investor uncertainty over the new Omicron Covid-19 variant being added to the melting pot. If inflation expectations continue to rise, then liabilities can be expected to increase further, however most schemes do have significant protection in place in the form of capped inflationary increases on benefits and inflation hedging investments”

How member options can add value

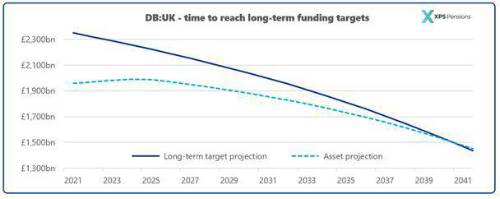

After allowing for the combination of investment returns and current cash contributions agreed with employers (which typically run to 2024/25) it will take schemes c.19 years to reach their long-term targets. This is slightly longer than the timeframe by which cashflows peak and schemes are estimated to be ‘significantly mature’, a measure that The Pensions Regulator has indicated it will use as part of its proposed changes to the scheme funding regime.

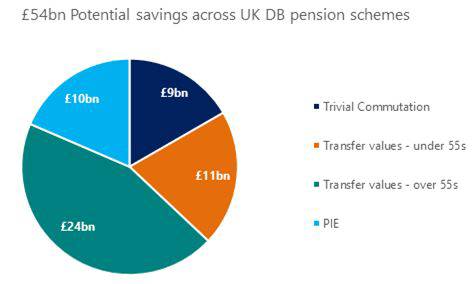

An analysis by the XPS Member Options team has revealed that member options, on typical terms and take-up rates, could reduce liabilities on long-term funding targets by around £54bn, reducing the time to full funding by as much as four years. The potential for savings, however, will vary from scheme to scheme depending on a scheme’s membership and structure. Typically, schemes with higher pension increases and younger memberships will have the most to gain from a funding perspective.

Paul Hamilton, Consultant, said: “The provision of member options has benefits for all stakeholders. Members have choice over how they access their benefits to suit their own personal circumstances whilst trustees and employers can benefit from funding gains and risk reduction. Helping members understand their choices is key to unlocking the potential of member options, as informed members are more likely to make use of member options and, importantly, are less susceptible to pension scams.”

|